-

Bertrand Martine ha respondido a How do you see the future of P2P lending platforms?Bonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

canythould43 ha respondido a Envestio - Another P2P Lending Scam ?This week Estonian police started a criminal investigation regarding the crowdfunding platform Envestio. The case is being investigated as investment

-

ariel23 ha respondido a Envestio - Another P2P Lending Scam ?Website has disappeared. One of their team says hackers attacked their database !

-

canythould43 ha respondido a kuetzal is announcing a wind-downToday I received an e-mail from Envestio, reacting on the recent developments around Kuetzal. Envestio reacts to panic on Baltic crowdfunding market,

-

ariel23 ha respondido a kuetzal is announcing a wind-downIn December 2019, it was made public a significant number of facts that undermine completely the credibility of Kuetzal as a reliable P2P platform. Y

-

runted ha respondido a Peer-to-peer lender Funding Secure goes into administrationOn FundingSecure home page: Important UpdateFundingSecure Limited ("the Company") Jonathan Avery-Gee, Edward Avery-Gee and Daniel Richardson (‘the Ad

-

sedgerhy10 ha respondido a How do you see the future of P2P lending platforms?The P2P lending platform is going to manage well if people are going to be willing to invest. Everyone who wants to lend on a P2P platform needs to ma

-

runted ha respondido a How do you see the future of P2P lending platforms?P2P lending is powerful — on many levels. It’s a way of saying goodbye to the presence of big banks — you know, the same ones that got their bail out

-

-

kentemad ha respondido a How do you see the future of P2P lending platforms?Experience of investors will determines the future p2p lending

-

runted ha respondido a Is P2P lending a good way to make money?There’s no easy way to make money and p2p lending is tremendously great, however, mostly sold to people who wouldn’t otherwise put money at risk this

-

canythould43 ha iniciado una nueva discusión Is P2P lending a good way to make money?Is P2P lending a good way to make money? ...

-

Try Bondora, Viventor, Twino.

-

runted ha iniciado una nueva discusión Which peer to peer lending sites are available to overseas investors?Which peer to peer lending sites are available to overseas investors? ...

-

canythould43 ha iniciado una nueva discusión DoFinance is terminating the user agreement and closing investors' accountsThe operating company of the DoFinance platform has been granted the investment brokerage license by the Latvian regulator. Since DoFinance won't o ...

-

canythould43 ha iniciado una nueva discusión Cash drag on Esketit, Robocash and PeerBerryThe availability of loans on best-performing P2P lending platforms is limited. Investors who wish to invest larger amounts should consider alternat ...

-

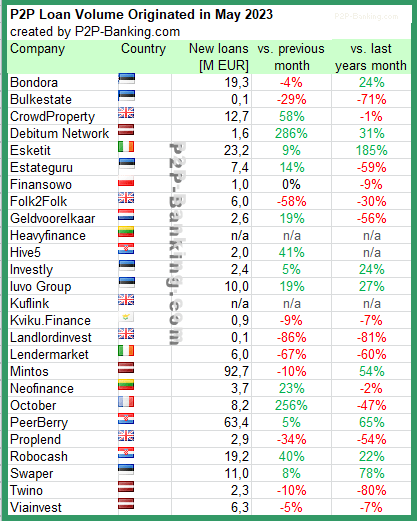

Last year, the most popular P2P segment of consumer lending had reduced volumes. According to P2PMarketData, the decline was -25%.

“The consumer P2P investment scheme is characterized by relative ease of use and the option of a fairly quick exit. This may have led to an accelerated outflow of funds during the market crisis.” - platform analysts comment on the situation.

Funding for the real estate sector remained at the 2021 level of €700 M. “Obviously, against the backdrop of a pan-European rise in inflation, rising prices for energy carriers and other negative factors, the year was not the best in terms of the development of serious real estate objects.” - experts add.

At the same time, business lending in the European market has expanded and continues to grow. To date, the volume of the sector has reached €300 M. “As the main reason we see the tightening of the credit policy of the traditional banking sector and the growing wariness of venture investors. -

-

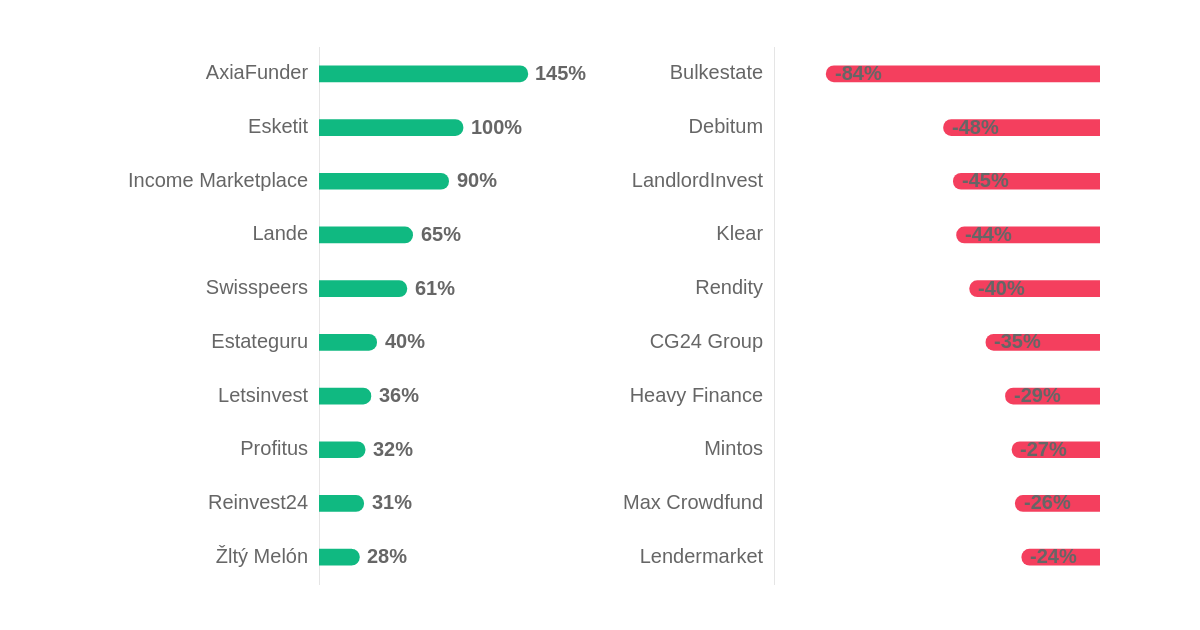

AxiaFunder – an equity crowdfunding platform from United Kingdom, offering other investments, has been the fastest growing platform in the last year, followed by Esketit and Income Marketplace. The “rising stars” were most likely to be direct marketplace lending platforms (7 out of 10), come from Estonia (3 out of 10), and offer property investments (4 out of 10).

Bulkestate, Debitum, and LandlordInvest have performed the worst compared to the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (7 out of 10), come from Latvia (2 out of 10), and offer property investments (5 out of 10). -

Reinvest24 ha añadido un nuevo vídeoDear community,

2020 was a very interesting and challenging year for a lot of businesses. But we do love to say that each challenge has an opportunity for growth. In this video, our CEO Tanel Orro would like to make a recap on what happened in 2020 at Reinvest24, what we achieved and to share some of our plans for the year of 2021.

Also, Thank You for Your continued support, trust in us and we look forward to being Your reliable, long-term investment partner also in 2021.

Reinvest24 teamReinvest24 2020 video overview 2020 was a very interesting and challenging year for a lot of businesses. But we do love to say that each challenge has an opportunity for growth. In ... -

European investors have raised the alarm on Estonian peer-to-peer platform Envestio, which has seemingly shut down while still holding €33m (£27.87m) of lender funds. Over the past week, worried investors have taken to social media and P2P forums to complain that the company’s website is down.

-

canythould43 ha publicado un nuevo enlaceECN reports Kuetzal and Envestio to National Conduct Authorty - European Crowdfunding Network https://eurocrowd.org No description

-

canythould43 ha iniciado una nueva discusión Envestio - Another P2P Lending Scam ?This week the site Envestio is down and nobody is replying to any contact requests. Several investors write complaints on social networks and forum ...

-

canythould43 ha iniciado una nueva discusión kuetzal is announcing a wind-downToday I received an e-mail from Kuetzal explaining the situation at the company and announcing that there are going into a wind-down. Dear Kuetzal ...

-

kuetzal is announcing a wind-down. Today I received an e-mail from Kuetzal explaining the situation at the company and announcing that there are going into a wind-down.

-

canythould43 ha publicado un nuevo enlace7 signs a P2P lender may be heading for disaster https://explorep2p.com If you are a P2P investor, here's 7 signs that your investment may be heading for trouble. Compare more than 50 European P2P sites and find the best o ...

-

-

The peer-to-peer industry has been dealt another blow after lending firm MoneyThing announced it was closing down with immediate effect.MoneyThing peer-to-peer platform closes its doors with 44pc of loans in default https://www.telegraph.co.uk The peer-to-peer industry has been dealt another blow after lending firm MoneyThing announced it was closing down with immediate effect.

-

canythould43 ha publicado un nuevo enlaceP2P lenders spread wings as search for yield intensifiesP2P lenders spread wings as search for yield intensifies https://www.smh.com.au As interest rates drop to record lows, investors are looking for new ways to maintain their retirement incomes

-

canythould43 ha publicado un nuevo enlaceinvestors who did not follow information through other channels (such as LHV forums, Facebook, Äripäev) will end up taking losses that active (or informed) investors managed to avoidCrowdestate communications disaster | Money Is Your Friend http://moneyisyourfriend.eu No description

-

canythould43 ha iniciado una nueva discusión Peer-to-peer lender Funding Secure goes into administrationPeer-to-peer pawnbroker Funding Secure has collapsed, leaving thousands of investors at risk of major losses. Funding Secure is the second peer ...

-

canythould43 ha iniciado una nueva discusión How do you see the future of P2P lending platforms?How do you see the future of P2P lending platforms? ...

-

Tanel offered me to run a raffle where you can win €50 for registering on the platform and passing KYC. Full details https://www.honestfire.lt/reinvest24-raffle/

-

HonestFIRE ha publicado un nuevo enlaceHi, I've had a pleasure to interview Reinvest24 CEO and would like to share that with you.Reinvest24 Review and interview with CEO: Become a Landlord from €100 https://www.honestfire.lt Reinvest24's crowdfunding platform is unique in a way that the investors receive both rental income and long-term capital gains.

-

Hi, I’m the founder of Oxford Insurance Housing and Finance Limited looking for s P2P Loan. or Peer who wants to buy shares in my business Can anyone help?

Thanks and will give more info upon request -

Hi all

Looking for an urgent loan

Please if there’s anyone who could help please reach out so as to provide more information

Will pay with high interest rate in short period of time -

-

Another helpful guide for new indian p2p lendersHow To Mitigate Risk In Peer To Peer Lending: 5 Best Practices | Lendbox https://www.lendbox.in The risk in peer to peer lending investments can be mitigated or minimized very effectively if you take the following measures before funding a borrow ...

-

Helpful guide to those starting out peer to peer lending in IndiaIs Peer To Peer Lending Safe In India? A Detailed Overview - Lendbox Blog https://www.lendbox.in Wondering how safe is peer to peer lending in India? this blog will help you know more about peer to peer lending safety and risk for Investors in Ind ...

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE

This week Estonian police started a criminal investigation regarding the crowdfunding platform Envestio. The case is being investigated as investment fraud.

According to figures from the Envestio website before it went offline, around 33 million euros in investor funds were collected from around 13,000 investors.

There’s no easy way to make money and p2p lending is tremendously great, however, mostly sold to people who wouldn’t otherwise put money at risk this much. I’m a big believer into P2P but haven’t seen a very compelling model yet.

Today I received an e-mail from Envestio, reacting on the recent developments around Kuetzal.

Envestio reacts to panic on Baltic crowdfunding market, caused by collapse of Estonian platform Kuetzal, by returning its former COO Evgeniy Kukin back on his position.

The end of 2019 on Baltic crowdfunding market has been quite challenging for all players, as failure of Kuetzal platform caused a crisis of trust and provoked many investors to withdraw their funds from the market.

Envestio also faced a number of pre-mature investment buybacks and subsequent withdrawal of funds, which were accomplished without any delay and in full amount thanks to Envestio’s reserve fund, which in present circumstances varies from EUR 500 000 up to EUR 800 000.

Furthermore, in order to minimize the room for negative rumors and speculations, caused by changes in the management board of Envestio, which took place almost simultaneously with similar changes in Kuetzal (due to absolutely different reasons, though – Envestio was purchased by a solid European investor) the new owner of Envestio, Mr. Arkadi Ganzin has reached the agreement with former COO of Mr. Envestio Evgeniy Kukin to return to this position starting from January 15, 2020.

At the same time, Mr. Eduard Ritsmann, who was appointed to the position of COO and Development Director right after the sale of the platform in December 2019, will continue working for Envestio as the Head of Sales.

Hence, no parallels should be drawn between Envestio and Kuetzal cases, as Envestio retains onboard the whole team of professionals, with which it became one of the leaders of the Baltic crowdinvesting market, earned trust of almost 15 000 registered investors, and kept perfect payment discipline as well as is in command of solid financial reserves to ensure uninterrupted and trustworthy operational activity.

On FundingSecure home page:

Important UpdateFundingSecure Limited ("the Company")

Jonathan Avery-Gee, Edward Avery-Gee and Daniel Richardson (‘the Administrators’) of CG & Co (‘CG’) were appointed Administrators of the Company on 23rd October 2019. The administrators are working closely with the FCA who consented to their appointment over the Companies.

The Company was placed into administration on 23rd October 2019 by a resolution of the board of directors of the Company. As a result of the administration no legal proceedings may be commenced or continued with against the Company without the consent of the Administrators or leave of the Court. The Company is now protected from any third party actions by virtue of a statutory moratorium.

The administrators have set up a dedicated email address for creditors to contact the administration team.

fundingsecure@cg-recovery.com

We will only be able to respond to urgent queries. However, key updates on loans will be ongoing and accessable on the investor platform.

Due to the early stages of the administrations, the information we have is limited, we therefore request that creditors continue to consult the website and historic investor updates in the first instance. We will continue to update investors and creditors as additional information becomes available so please watch this website for updates.

The business and affairs of the Company are now controlled by the Administrators who act as agents of the Company and act without personal liability.

Jonathan Avery-Gee, Edward Avery-Gee and Daniel Richardson are licensed as insolvency practitioners in the United Kingdom by the Institute of Chartered Accountants In England and Wales and the Insolvency Practitioners Association.

Try

Bondora, Viventor, Twino.