-

salvo45 ha respondido a Already invested in Linked Finance?I've been using Linked Finance for a few months now and I like it.

-

canythould43 ha añadido un nuevo vídeoUnleash Your Ambition: Lolly And Cooks - Linked Finance Laragh Strahan is among a growing number of ambitious Irish business owners who now use Linked Finance when they spot an opportunity to expand. Linked ...

-

canythould43 ha añadido un nuevo vídeoLinked Finance - Start Lending - How it Works LinkedFinance offers a new and painless way for Irish businesses to borrow money (business loans/funding) from a large group of real people, including ...

-

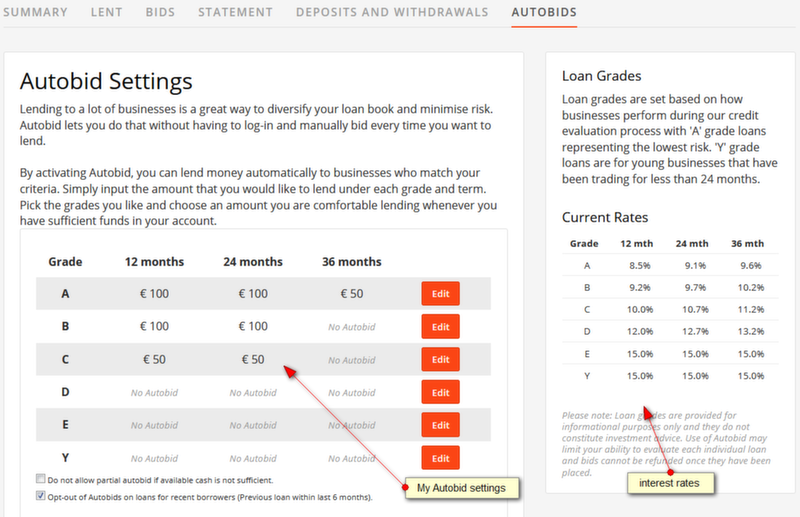

canythould43 ha añadido una nueva fotoUse the Autobid (autoinvest function) to invest. While it is possible to make manual bids, many of the smaller loans are funded in minutes. The Autobid lending tool allows you to bid automatically on 'Live Loans'. You can find Autobid in the 'My Account' section. It's on the furthest tab to the right.

-

canythould43 ha iniciado una nueva discusión Already invested in Linked Finance?Already invested in Linked Finance? If so, share your impressions below. Are you happy with Linked Finance? Have you encountered an issue that othe ...

-

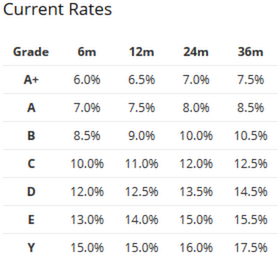

Borrowers are exclusively (small-scale) Irish companies (SMEs). The duration varies from 6-36 months. The interest is fixed and there is no bidding process. As an investor you can get detailed information about each loan.

-

Logging in is really straightforward - if you know the English language, that's done in a few minutes. The obligatory identity card scan and a confirmation of address (bank letter, etc.) is required only on withdrawal. Deposits can be made very easily by credit card.

-

-

Linked Finance offers unsecured P2P here. There are no "guarantees" or promises as with most Baltics platforms like Mintos , Robo.cash o rpeer Berry but there are simply credit losses with which you have to expect. However, default rates are very moderate. Each quarter, Linked Finance publishes its Loanbook, with various statistical data. This can be found under the statistics , but you have to be logged in

-

canythould43 ha publicado un nuevo enlaceThe largest platform for alternative finance in Ireland says managing cash flow and working capital a key consideration for may Irish firms Brexit preparations including many of the businesses who already use the Linked Finance.Irish P2P lender Linked Finance launches ‘Brexit loans’ - AltFi News https://www.altfi.com The largest platform for alternative finance in Ireland says managing cash flow and working capital a key consideration for may Irish firms Brexit pre ...

I've been using Linked Finance for a few months now and I like it.