How Much Do You Make With P2P lending?

Anyone who first hears about peer to peer lending and its amazing high-netting return potential is incredulous about all of its claims…I was…you were….everyone was! It just sounds like a scam.

After the initial skepticism was overcome (through research and a bit of trial and error) You got hooked but still found it hard to explain to others how it all works. How and why peer-to-peer lending platforms are capable of generating annual return rates between 8% and 10%….those numbers just sound too crazy to be true….

By now you know they aren’t fantasy as you managed to make a 8% return on one platform and 10% on some other…. With this post I will explain how exactly p2p lending platforms are capable of generating such high ROI for its lenders…

How peer-to-peer investing works

Peer-to-peer (P2P) investing is a type of investment in which individuals lend money to borrowers through an online platform, rather than through a bank or traditional financial institution. Borrowers can be individuals or small businesses seeking loans for various purposes, such as consolidating debt, funding a startup, or paying for home improvements.

Investors can browse loan listings on the P2P platform, which typically include information about the borrower's creditworthiness, the loan amount, the loan term, and the interest rate. Once they have identified a loan they are interested in, they can fund all or a portion of the loan.

In most cases, P2P platforms use a mechanism called "automated underwriting" which assesses creditworthiness of the borrowers by using various data sources and algorithms.

The returns on P2P investments can be higher than traditional savings accounts or bonds, but they also come with higher risks, as borrowers may default on their loans. To mitigate this risk, many P2P platforms allow investors to diversify their investments across multiple loans, and often require borrowers to provide some form of collateral.

It's important to note that P2P investing is generally considered to be higher risk than more traditional forms of investing, and P2P platforms are not subject to the same regulations as traditional financial institutions. The lack of regulation means that P2P platforms may offer more high-risk loans, which may mean higher returns for investors but also higher risk of losing some or all of the invested capital.

The major players in the peer-to-peer universe

There are several major players in the peer-to-peer (P2P) lending universe. Some of the most well-known and established P2P lending platforms include:

- Lending Club: Lending Club is one of the largest and oldest P2P lending platforms in the world, and operates in the United States. It was founded in 2007 and went public in 2014. The platform allows individuals and businesses to borrow money, while investors can fund loans and earn interest on their investments.

- Prosper: Prosper is another major P2P lending platform in the United States that was founded in 2005. Like Lending Club, it allows borrowers to apply for loans and investors to fund loans and earn interest.

- Upstart: Upstart is a P2P lending platform that uses alternative data, like education and employment history, to assess the creditworthiness of borrowers. it operates in US and Canada.

- Zopa: Zopa is a P2P lending platform based in the United Kingdom that was founded in 2005. It operates in UK and Italy, it allows borrowers to apply for personal loans and investors to fund loans and earn interest.

- Funding Circle: Funding Circle is a P2P lending platform based in the United Kingdom, which focuses on providing loans to small and medium-sized businesses. It operates in several countries like UK, US, Germany and others.

- Mintos: Mintos is a P2P lending platform based in Latvia that allows investors to fund loans originated by various P2P lending platforms and other financial institutions in multiple countries.

There are also other P2P lending platforms operating in different countries such as China, India, Europe and many more.

These platforms have different target audiences and borrowers, and use different methods to assess creditworthiness, so it's important to research the platform and the loans you are considering investing in before making a decision.

How Do You Earn Money?

There are several ways to earn money through peer-to-peer (P2P) lending:

- Interest: One of the main ways to earn money through P2P lending is by receiving interest payments on loans you have funded. Borrowers are required to make regular payments on their loans, which include both principal and interest. As an investor, you will receive a share of these payments proportional to the amount you have invested.

- Late fees: If a borrower falls behind on their payments, they may be charged late fees, which can also be passed on to investors as additional income.

- Defaulted loans: In some cases, borrowers may default on their loans, which means they are unable to make any further payments. If this happens, P2P platforms will typically attempt to collect on the defaulted loan, either by selling the debt to a collection agency or by foreclosing on any collateral that was put up as security for the loan. Any proceeds from these actions will be distributed to investors according to the terms of the loan.

- Loan origination fees: In addition to the interest on loans, borrowers are also charged an origination fee when they take out a loan. This fee is typically a percentage of the loan amount and is used to cover the costs of underwriting and servicing the loan. Some P2P platforms share a portion of this fee with investors as additional income.

It is important to remember that P2P lending carries risk, and the return of investment is not guaranteed. An investor may lose some or all of their invested capital, so it is important to research the platform and loans carefully, and to diversify investments across multiple loans to mitigate risk.

P2P Lending Performance

The performance of peer-to-peer (P2P) lending can vary widely depending on the platform, the types of loans offered, and the creditworthiness of the borrowers.

Historically, returns for P2P lending have been higher than traditional savings accounts or bonds, but they also come with higher risks, as borrowers may default on their loans. However, P2P lending platforms have been able to offer competitive returns because they can underwrite loans more efficiently, and often charge borrowers higher interest rates than traditional financial institutions.

In general, P2P lending platforms have reported historical annual returns of around 5-10% for investors, but it is important to note that these numbers are not guarantees and past performance does not indicate future results.

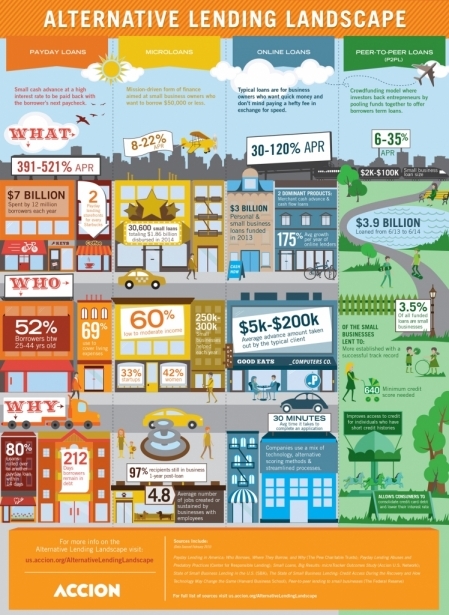

The rise of the internet and deregulation of traditional banking and lending were the enablers of a new alternative lending landscape that emerged at the turn of the century.

Basically there are different types of loan offerings for different type of needs. And we have to look at the different type of loan offerings to understand the high interest return rates being offered by peer to peer lending platforms.

Payday loans

Payday loans (are small money advances at a very high interest rates to be paid back when the borrower receives his next paycheck. Common interest annual percentage rates (APR) are in the 391-521% range!!!!!!

Most borrowers using payday loans have bad credit and low incomes and therefore may not have access to credit cards and are forced to use the service of a payday loan company. Payday loan providers therefore can charge exorbitant high interest rates which are calculated on a daily or weekly base e.g. $17.50 interest fee per $100 borrowed for seven days. Most loans are for 30 days or less with loan amounts usually between $100 to $1,500.

The borrower typically writes a post-dated personal check in the amount they wish to borrow plus a fee in exchange for money. The lender holds onto the check and cashes it on the agreed upon date, usually the borrower’s next payday. These loans are also called cash advance loans or check advance loans.

In the USA alone 12 million people use payday loans with a total borrowed amount of $7 billion.

Micro loans

Micro loans are a mission-driven form of finance aimed at small business owners who want to borrow $50,000 or less. The interest APR is commonly in the 8-22% range.

According to the Small Business Administration, its microloan program provides micro loans in order for businesses used “for working capital or the purchase of inventory, supplies, furniture, fixtures, machinery and/or equipment.”

In banking terms, a microloan is a very small loan ranging from $500 to $100,000. Historically, banks in the United States haven’t particularly liked dealing with microloans because they have not been profitable financial products for them to market. Other financing companies and institutions have filled this void.

Online loans

Typical loans are for small business owners who want/need quick money and don’t mind paying a hefty fee in exchange for speed. Typical annual percentage rates range from 30-120%.

In its broadest sense, online lending is any kind of loan that’s not directly from a traditional bank and often online lenders are technology companies that use different methods to communicate with clients, base rates and approval on metrics other than your FICO credit score and similar traditional measurements and apply a different (frequently streamlined or automated) approval process compared to traditional lenders.

This enables them to provide loans super quickly when money is needed by a borrower.

P2P lending’s high return rates explained

p2p lending marketplaces arose in 2005 by combining the alternative finance services as described above with crowdfunding. Basically peer to peer platforms cut out the middleman aka the payday/micro/online loan provider by bringing borrowers and lenders directly together through their platform/marketplace.

By doing this p2p lenders don’t need to have money at hand themselves which greatly reduces their costs. Their core competence is the platform technology and loan approval automation. By charging small fees (typically around 1%) they can create a highly profitable business that is beneficial for them, the borrower and lender.

The borrower can find loans with lower APR’s and the lender can get higher ROI on his investments in this new peer to peer lending model. Win-win-win for all three parties.

The high return rates investors can make on p2p lending platforms are understandable if you look at the loan services they compete with. Payday loans, micro loans, online loans all charge super high annual percentage rates to their borrowers. peer to peer lendng platforms offer these loans too but at much lower percentages due to their low cost structure.

In that light a payday borrower loaning money at say 30% interest on a p2p platform is not strange at all as he would pay a multitude of that through a traditional (payday) loan institution. And an accompanying ROI of 20%+ for lenders/investors is a logical consequence thereof. Just very sound business principles at work here.

How Can My Earnings From P2P Lending Become Passive Income?

Peer-to-peer (P2P) lending can be a way to earn passive income if you are able to invest in a large number of loans and reinvest the payments you receive from borrowers.

Here are some strategies that can help you achieve this:

- Diversification: Diversifying your investments across a large number of loans can help to spread risk and reduce the impact of defaults. By investing in a variety of loans with different terms and interest rates, you can create a steady stream of income that is less affected by fluctuations in any one loan.

- Automated investing: Some P2P platforms offer automated investing tools that allow you to set investment criteria, such as credit score or loan term, and automatically invest in loans that meet those criteria. This can help you to quickly and easily build a diverse portfolio of loans, with minimal ongoing effort.

- Re-lending: some platforms offer an option to re-lend the payments you receive from borrowers, this allows you to effectively "roll over" your investments and keep your money working for you. This process helps to maintain the steady stream of income over time.

- Compounding interest: compounding interest is the process in which the interest that you earn on an investment starts to earn interest on itself, amplifying your returns over time. The longer you invest, the more your money compounds, resulting in potentially higher returns.

It's important to note that P2P lending is not guaranteed passive income and you should carefully assess the platform and the loans you are considering investing in before making a decision. Also, different platforms might have different features available, so it's important to research the specific platform you want to invest with and see if the features you want are offered.

Can You Lose Money In P2P Lending?

Yes, it is possible to lose money in peer-to-peer (P2P) lending. P2P lending is a higher-risk investment compared to traditional investments such as savings accounts or bonds.

There are several ways in which you can lose money through P2P lending:

- Defaulted loans: The risk of default is a major concern when investing in P2P lending. If a borrower defaults on their loan, they will be unable to make any further payments and the investor may lose some or all of the invested principal.

- Scam platforms: P2P lending platform is not regulated as traditional financial institutions and there have been instances of fraud and scam platforms. It's important to research and invest only in reputable platforms and avoid those that show signs of being a scam.

- Lack of Diversification: Diversifying your investments across multiple loans and platforms can help to mitigate risk. If you invest all your money in one loan, you are exposed to the full risk of that loan.

- Lack of collateral: Some P2P loans are unsecured, meaning they are not backed by any collateral. The lack of collateral can increase the risk of default and therefore increase the risk of losing money.

- Interest rate risk: if the interest rates in the economy rise, it can make it more difficult for borrowers to make their loan payments, leading to increased defaults and potential losses for investors.

It's important to keep in mind that P2P lending can be a good option for those looking for higher returns than traditional investments, but it comes with higher risks as well. It is important to research and invest only in reputable platforms, and to diversify your investments to minimize risk and maximize potential returns. Keep in mind that past performance is not a guarantee of future results, and you should invest only the money you can afford to lose.

Start with a smaller amount

Starting with a smaller amount when investing in peer-to-peer (P2P) lending can be a good way to test the waters and get a feel for how the platform works before committing a larger amount of money.

Investing a smaller amount can also be a good way to diversify your investments and spread risk across multiple loans. By investing in a small amount in a variety of loans with different terms and interest rates, you can create a steady stream of income and limit your exposure to the risk of default on any one loan.

It's also important to keep in mind that P2P lending is generally considered to be a higher-risk investment compared to traditional investments, such as savings accounts or bonds, so starting with a smaller amount can help minimize the potential loss of your capital.

Additionally, starting with a small amount can help you to test out the platform, understand its user interface, and see how the platform handles your investments before committing more money.

It is important to keep in mind that it is not a guarantee of returns and past performance is not indicative of future performance. It's also important to research the platform and loans thoroughly before investing and to diversify your investments across multiple loans and platforms to minimize risk and maximize potential returns.

Choose a trustworthy lending platform

Choosing a trustworthy peer-to-peer (P2P) lending platform is crucial in order to protect your investment and maximize your returns. Here are some key factors to consider when evaluating a P2P lending platform:

- Regulation: Make sure the platform is regulated by a government authority and complies with laws and regulations. This can provide an additional level of protection for your investments.

- Reputation: Check the platform's reputation by reading online reviews, talking to other investors, or consulting with financial advisors. Look for platforms with a good track record of providing returns and ensuring the security of investor's funds.

- Transparency: Look for platforms that provide detailed information about their loans, including the creditworthiness of borrowers, the loan terms, and the interest rates. This will help you to make informed investment decisions.

- Platform's financials: It is also useful to know the financial position of the platform and its liquidity. This will help to ensure the platform will be able to handle the payment of interest and principal to the investors in case of a default.

- Diversification: Investing in a variety of loans across different platforms can help to spread risk and minimize the impact of defaults on any one loan.

- Secondary Market: some platforms might offer secondary market, this is a place where investors can sell their loans to other investors. A secondary market can provide liquidity and more options for the investors.

It's important to research and invest only in reputable platforms and to diversify your investments to minimize risk and maximize potential returns. Keep in mind that past performance is not a guarantee of future results, and you should invest only the money you can afford to lose.

related: Peer to Peer Lending Sites - Full List.

The rewards of peer-to-peer investing

Peer-to-peer (P2P) investing can offer several rewards for investors, including:

- Higher returns: P2P lending platforms often offer higher returns than traditional savings accounts or bonds, as borrowers are typically charged higher interest rates to compensate for the higher risk of default.

- Diversification: P2P lending allows investors to diversify their investments across a wide range of borrowers, reducing the impact of default on any one loan.

- Access to new opportunities: P2P lending platforms allow investors to access borrowers and loan types that may not be available through traditional financial institutions. This can include individuals or small businesses looking to start a new business, expand an existing one or consolidate debt.

- Social Impact: P2P lending can provide the opportunity for investors to make a social impact by providing funding to borrowers who would not have access to it otherwise.

- Direct involvement: P2P lending allows investors to be more directly involved in the lending process, giving them the opportunity to evaluate and select borrowers based on their own criteria and make lending decisions based on their own risk tolerance.

- Liquidity: Some platforms might offer a secondary market, this is a place where investors can sell their loans to other investors, this feature can provide liquidity for investors who need to exit the platform for any reason.

It's important to note that P2P lending is a higher-risk investment than traditional investments, such as savings accounts or bonds, and the return of investment is not guaranteed. It's important to research the platform and the loans you are considering investing in before making a decision, and to diversify your investments across multiple loans to mitigate risk.

Plataformas P2P

Comentarios

-

Lunes, 18 Octubre 2021

Lunes, 18 Octubre 2021Most of the time the person or lending organization requires access to the borrowers checking account and requires a direct deposit set up and then they can remove the payment as soon as the direct deposit is posted. That way they get paid and the borrower doesn't have to worried about paying it. But the payments are 80 to 100% interest only and the borrower needs to make extra payments or give permission for larger money's to be withdrawn.

The truth is that more than a 10% return sounds incredibly attractive in these times. I am not an expert, but if that is so, what are the interests that the borrower is paying?