International Peer to Peer Lending Sites

Peer-to-peer lending is a contemporary name for an old practice. People (peer lenders) lending funds directly to family, friends, and acquaintances. The modern p2p website utilizes the internet to introduce borrowers and lenders investing in p2p loans worldwide.

The concept behind p2p lending international sites is that borrowers pay lower rates of interest while investors get the best p2p lending rates by simply cutting out intermediaries. When using peer-to-peer lending platforms, you eliminate banks from the equation. This is one of the investment precincts that has grown in the financial crisis. Due to its versatility and best rates, the peer to peer lending business has surprisingly improved and proved to be a viable investment.

Diversification is essential in the p2p landscape and it is always worth identifying a promising p2p lending platform. Find, compare or review the best international peer to peer lending sites.

Disclaimer: Links leading you to products or services are affiliate links that I will receive compensation from. The listing is sorted by the 'most rated'. Keep in mind that the platforms are rated by the community members thus commissions doesn’t affect our choice. Whether or not you decide to follow the links is completely up to you.

Choose a filter below:

Why invest through a p2p lending platform?

P2P Lending is interesting because it is a fixed-income asset that is not available via other channels. Fixed-income assets mean that the terms of the investment are fixed. The duration of your investment could be 1 years for example and it is agreed before you make the investment.

The interest rate or return you should be making is also fixed and it is agreed in the loan contract that you basically sign with the borrower and it could be 8 to 10%. Then also the payment dates are fixed.

One thing that is very common is to have monthly repayments. Every month the borrower will pay an annuity payment that comprises of interest and principal, and over the term of the loan, the loan would be fully repaid including the interests.

International peer to peer lending sites

Nowadays P2P lending is experiencing robust growth. In this article, we would want to offer details on the best p2p lending sites open to international investors. The minimum investment in most p2p lending platforms listed below is 10 Eur. It's worth a try. You will learn along the way !

Legal Anti-Money-Laundering Law requires the platforms to verify identities of investors. In those trustworthy loan sites that are detailed above, you are qualified to invest if:

- You've at least 18 years of age

- You have a document to verify your identity. E.g. Utility expense, Legitimate passport or tax certificate ...

- You have a bank account.

What is P2P Lending Investing?

Peer to peer lending abbreviated, as P2P lending is the practice of lending money to different unrelated people without going through traditional banks processes. All the activities take place online on the companies’ investing websites after going through bad credit checking tools and using different lending platforms.

According to the Wikipedia definition, this is the practice of borrowing funds for individual borrowers or businesses through an online platform that directly connects them with peer lenders. Companies providing such peer-to-peer loans work entirely online, with their lower operating costs allowing them to borrow money - very often at a far lower price than traditional financial institutions.

Thus, borrowers benefit from lower interest rates, and lenders achieve higher returns on their capital than other savings products.

The sites providers (P2P lending platform) receive a percentage of the loan amount against their brokerage services. Their function is in practice to meet potential borrowers and lenders. Most of these types of loans are unsecured loans, most of which are aimed at small business.

Interest rates on loans are often determined by lenders based on the reverse auctions model or the lowest interest rate on which they lent their funds. Another way may be based on a fixed interest rate, depending on the minimum credit score and credit rating.

On some online lending platforms, in order to reduce the risk and volume of bad loans and bad credit, creditors themselves decide whether to allocate funds to a borrower or not.

How has the business started?

After the end of the financial crisis real estate bubble, borrowers began to look for lower interest rates and access to credit. On the other hand, lenders were looking for a higher return on their investment. Banks, struggling with tight regulation, have encountered serious obstacles to meeting the growing market needs.

This created a serious vacuum in peer-to-peer lending market, filled with peer to peer lending sites and real estate crowdfunding platforms. They are characterized by a lower level of regulation because they are intermediaries in the relationship between creditors and borrowers.

The peer-to-peer lending industry has seen significant growth, especially in developed countries with biggest financial markets and fintech startups. In the United States, Lending Club started at the end of 2007, Lending Club have survived the 2008 recession. These platforms have granted 6.6 billion in loans, or 128% growth over the past year, with the country's largest volume market. One could argue that P2P loans might not even be around today if it was not for Lending Club.

In terms of the amount of single credit granted, however, the United Kingdom is ahead of the US, with the size of 72% larger. As of 2019 Funding Circle has facilitated over £7 billion in loans to small businesses.

Alternative financial markets in Europe reached a volume of nearly 3 billion euro in 2014, an increase of 144% on an annual basis, according to the same Business Insider survey.

In France, for example, the small market for P2P-lending has grown by 4,000% in the past year to 8,2 million Euro. This type of peer-to-peer lending is already gaining momentum in countries such as Germany, Sweden and the Netherlands.

Experts believe that Latin America is the next region in which this type of investing will experience a real boom.

Peer to peer lending sites for investors– Which Is better, a savings account or peer-to-peer lending?

People often worry about how they will manage to save enough money for larger expenses down the road, for retirement and or for any number of other issues. In fact, the concern about being able to save enough money to live comfortably is one of the major stresses that weighs on the minds of most individuals. If you are one of those individuals, you might be wondering whether you should put your money in a bank account and forget about it or get involved in peer-to-peer lending, also referred to as P2P lending.

The truth is, there are advantages and disadvantages to both of these systems. With that being said, it is vitally important that you fully understand what the potential benefits and risks of each one are so that you can make an educated decision concerning your future.

Advantages and disadvantages of deposit account

Many people put their money in a savings account and hope for the best. It is understandable because this is the safest method of saving for the future. Unlike stocks and bonds, you don’t have to worry about having more money than you know what to do with one day and then having it all wiped out through no fault of your own the next. For many people, this alone is enough to make them decide what to do.

However, you might not have considered the idea that when you put money in an interest bearing account, any money that goes into the account is largely what you are capable of putting their yourself. This means that you are taking a chunk of money out of your own paycheck in order to have any hope of saving money for the future. Money that is earned from the cash that is already sitting in the account is typically not even enough to get your attention. This means that your money is not working for you when that is exactly what it should be doing.

Peer-to-peer lending

Essentially, this is a form of lending space that uses a certain platform in order to help people decide which businesses they should invest in. It is safer than typical stocks and bonds and there are several other things about this type of investing that are quite beneficial. For one thing, you have greater control over your decisions and thus, over your money.

There is also the potential for greater earnings because you are directly involved with the business that you choose. If it does well, so do you. Because you have a personal finance stake in it, it gives you more control over choosing a business that will be successful in the future. It also gives you the opportunity to be involved in selected businesses that you have a genuine interest in.

Potential risks

Of course, there are risks involved in everything, especially things that are really worth doing. When it comes to peer-to-peer lending, the risk is that you will invest in a small business that might fail. If it does, you might not get a return on your lending investment as you had expected. This is especially true if the small business fails shortly after you have made the decision to invest because it gives you very little time to recoup any of that money. These risks can be minimized by doing your homework and investing in businesses that have a proven track record.

The very idea of taking risks with your money is a little frightening. However, people that are unwilling to take risks are usually the ones that end up paying the price for it in the end. You have probably heard the saying that little risk offers little reward. For the most part, this is true. If you want to have the potential to grow your wealth management and do it in the safest way possible, peer-to-peer lending is definitely something that you should look into.

Is peer to peer lending safe?

Achieving financial independence is not as complicated as one might think but as with any financial decision, there is some risk involved with lending platforms. Lenders and borrowers alike must be aware of the risks associated with this innovative way of obtaining financing and how they can minimize these risks.

As those who fund the loans, lenders face the most risk. The most obvious risk for lenders is that borrowers will not pay the money back. With rare exceptions, there is never an absolute guarantee that the lender will get all of his or her money back when he or she makes a loan.

A careful examination of any available data about the borrowers and their financial situations will help you select low-risk borrowers. Using a third-party company or website that has some sort of vetting process for its borrowers can also help you separate those who are likely to repay their loans from those who are likely to default.

Most peer-to-peer lending sites and marketplaces in Europe provide unsecured personal loans or P2P business loans, meaning there is no collateral to back the loan. Platforms use an extensive analysis of each person and small business that applies for a loan taking into account many factors the likes of monthly income, are they homeowners or not, debt history, credit card payment history,….etc.

By analyzing these factors they create a risk profile and based on that they decide if the applicant gets a loan and for which interest rate.

High-risk real estate loans in Europe offer retail investors and institutional investors high interest rates but at the same time, they have a high chance of defaulting. A borrower is said to have defaulted loans when it fails (for any reason) to meet its repayment obligations – such as missing a monthly repayment installment.

Default rates are generally used to measure the average rate at which borrowers are expected to default across a given peer-to-peer investment platform. Default rates are generally derived from historical data and therefore cannot be used to predict the future default rate of a platform with any certainty.

As there is no collateral this can mean that an investor loses his invested/lent money. By diversifying your loans over many different loans with varying risks you can lower your risk…and this is what most investors do.

When Mintos platform entered the European market lending industry they decided to offer secured loans. Up to that moment, this had not been done on a large scale yet in the P2P lending sites. And Mintos, therefore, created a great new addition to these loans.

Buyback guarantee secured P2P loans will net you, as an investor, less interest than unsecured loans, but it will greatly reduce your risk, as Mintos loan originators will buy back the loan whenever the borrower defaults on his payment obligations for 60 days or more. In such a situation, the loan is automatically bought back by the loan originator from the investor at the nominal value of the outstanding principal, plus accrued interest rate.

This is a great system that greatly reduces your risk. However, as an investor, you must be aware that such a buy-back guarantee can also be cancelled. If credit losses accumulate on a platform, it can only cover it up to a certain point. After all, even the platform cannot afford to buy unlimited debts.

What is the actual return that you can expect from P2P lending

Obviously that can be a broad range because peer to peer lending sites and peer to peer companies covers a pretty broad set of different segments. You may invest in personal loans or payday loans at the beginning then you may invest in small business loans or larger business loans and it can even go to relisted loans.

Today peer to peer lending exist for quite a few years and there are international peer to peer lending sites that cover a lot of these different segments and they pay different interest rates which mean that the returns can be different.

The best p2p lending rates you can expect for international peer to peer lending sites are around 8% to 10%. When you compare that to what your bank would pay you on a fixed term deposit for example, in most of the cases this will be significantly more and this is what's make investing p2p loans such an attractive asset class.

Because it has a relatively better risk and return relationship than a lot of other similar assets. This is the reason why peer to peer lending is really exciting and why it's definitely worth spending time with it.

Related: How Much Do You Make With P2P lending?

Basically platforms cut out the middleman aka the payday/micro/online loan provider by bringing borrowers and investors directly together through their platform / lending marketplace.

By doing this p2p lenders don’t need to have money at hand themselves which greatly reduces their costs. Their core competence is the platform technology and loan approval automation. By charging small fees (typically around 1%) they can create a highly profitable business that is beneficial for them, the borrower and lender.

With P2P finance. You are also getting interest and principal monthly payments for each loan. This interest is added to the principal of a deposit or loan thus the extra interest brings more interest. This increase of interest is known as compounding. In comparison to simple Interest at which just the original capital earn interest, the compound interest gives more advantage for Lenders.

The low minimum investment makes diversification easy. The social lending character implies that you must construct a portfolio of hundreds of loans at which each loan is a small percent of the total portfolio.

Being diversified across several loans and platforms is among the secrets to having a successful experience when investing in social lending websites. Like other investments, diversification will lower the possibilities of your investment returns volatility.

This strategy will provide you more stable returns on your investment and lower your exposure to the risks associated with platform and any individual borrower defaulting on their loan. With this simple strategy, you can normally achieve a consistent return of 8 - 10%.

If you feel that it is time to let the money earn themselves, investing in loans might be the right option for you.

P2P Platforms: How to Invest in P2P Loans

Step 1: Select a peer-to-peer platform

First, select a company on which you want to make your investment. Criteria by which you choose or against a platform can be:

- Year of creation: Be careful with young companies. Platforms that have been on the mark for a long time are usually more trustworthy.

- Insolvency of the P2P platform

- Headquarters: Platforms from Europe have the advantage that communication is easier in the event of a bankruptcy of the platform during judicial disputes.

- Investment Amount and Term: Check how much the investment amount is on the platform and what maturities are offered. Low investment amounts and short-term personal loans maturities enable high diversification and are therefore less risky.

- Platform Origination Fee: Check if the platform charges an origination fee for arranging a suitable loan application, some peer-to-peer credit platforms do so. Lending Club and Prosper do charge origination fees.

- Currency, market trends ...

If you have chosen a platform, register online. To do so, follow the instructions of the respective website.

Step 2: Select a P2P financing project

In the second step, select a project you want to invest in. The platform provides you with information on the individual loan requests: the person of the borrower about the project to be financed and — most importantly — the creditworthiness of the debtor.

Based on several hundred factors, including information from credit valuers, the platform creates an individual credit score for each loan application. This will give you guidance on how much the probability that a borrower will repay the money as expected.

The expected return is also based on the credit quality class and credit history. Good credit means low return prospects, but the risk of default is also low. A low credit rating, on the other hand, carries a high risk for your investment, but the expected return is also high.

Auto invest through the P2P platform as an alternative to manually selecting investment projects, you can choose the automatic distribution of your capital by a portfolio manager on most platforms. The latter assigns your money to one or more credits.

To do this, you deposit once how much risk you want to take and how high the investment per loan should be at least and maximum. You can also decide whether you want to refinance your profits.

Step 3: Disburse your return

The disbursement of your return will be based on the platform you wish (that is, if you want to end your investment) or along with the capital used. If you want your money back before the end of the loan term, you can usually sell the loan to another lender for a small origination fee.

Which online loan site is the best

So now that we have covered why it may be a good idea to invest in money lending websites and microlending websites we will come to how to craft a strategy because once you've decided to invest in this asset class you will also need to come up with a way of how to choose best p2p sites to invest in.

When you craft your peer-to-peer investment strategy, there are seven crucial points you should be thinking about and you should define before starting to invest. There are some importants points which may act as a key factor in deciding upon the peer to peer websites of your choice.

Related: How to Lend Through P2P Lending Platforms.

Here are the best p2p lending sites for investors

PeerBerry

PeerBerry peerberry.com joins the P2P platforms in the European market. Investors can set the user interface in English and German, Peerberry is one of the easiest P2P platforms to use.

The main product is short-term loans from Eastern Europe with a maturity of 30 to 60 days. Investors never tie up their money for more than two months. This is not always possible with many other P2P platforms.

Many investors are skeptical when it comes to financing short-term consumer loans. The platform is aware of this and offers a buyback guarantee on almost all investments. This should be activated as soon as the payments for your loan are more than 60 days late. The lender buys back your investment in this case.

Who can invest in PeerBerry ?

PeerBerry is open to investors in the Europe, US, UK and several other countries.

Mintos

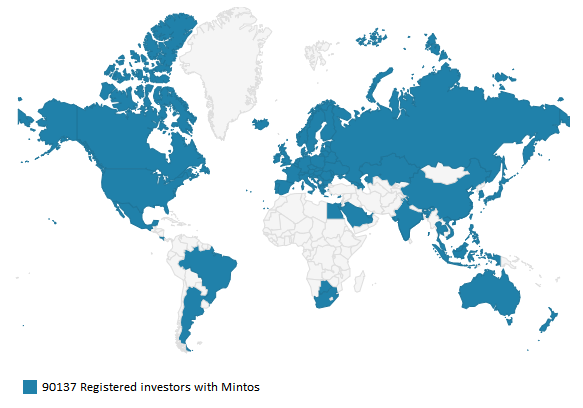

Mintos www.mintos.com has the peer to peer lending best rates. Mintos is one of the best peer to peer lending and the biggest p2p platform. At Mintos, Latvia. Both institutional and retail investors can invest in fractions of loans.

Currently, they serve small-company loans, private loans that are unsecured, secured auto loans, and home mortgages. The minimum investment in one loan is EUR 10.

They have plenty of loans to invest, and they also make it possible for just about any individual to select exactly what it desires. Since it brings together investors and loan originators like Capitalia, Mogo loans and Debifo among others. Mintos harbors some substantial distinctions to other peer to peer platforms!

Who can invest in Mintos ?

Both individuals and entities can invest through Mintos. Individual investors must be at least 18 years old, have a bank account, and have their identity successfully verified by Mintos.

Mintos accept money transfers from bank accounts or payment services in the European Economic Area and also in United States, Australia, Brazil, Republic of South Africa, Hong Kong, India, Japan, Canada, South Korea, Mexico, Singapore, Switzerland, and serveral other countries.

The complete list of international p2p lending sites

Other p2p investing sites which say they accept international investors in their Terms and Conditions are Rebuilding Society in the UK, Pret union in France, Bitcoin lending platform Bitbond in Germany and peer to peer lending club and websites like prosper in the US.

I think we'll see a growing number of lending companies names that allows any p2p lending international investor or borrower to use these platforms.

Related: Peer to Peer Lending Sites - Full List.

Will the P2P Lending Platform Survive?

The investment platform is going to manage well if people are going to be willing to invest. The problem today with the lending platform is that it looks more like charity than it does like a good idea. There are many platforms that people do not think are safe, and there are even more people who want to have a more solid platform to use. You have to understand how the platform works before you would use it.

Safety

People are going to want to have a way of making sure that the personal loans are paid back because people want to help if they are going to be safe. This means that people are going to have to look into the protection plans that are going to make it much easier for people to get the help that they need. You might want to give people the money they need, but you want to be as protected as a bank. You want to have a contract and a platform where someone is going to pay you back.

Reviews

There are many people who are going to be able to read reviews that are going to tell them that some of these platforms are not going to be safe. People are going to get scared away from some of these platforms, and that is going to make it much easier for people to say no. People are going to have to dig deeper to make sure that you are going to go to the place that you are going to feel much better about where you are spending your money.

Setup

You want to be able to learn as much as you can about the people that you are loaning money to, and you want to find a P2P platform that is going to help you make sure that you are comfortable. You are going to want to feel much better, and you are going to be able to stay safe if you are doing a lot of lending. No one has tried to really make a business out of this yet, but the setup could help people make sure that they are going to do it right every time.

The Companies

You have to make sure that you are going to use the companies that you believe in the most. A lot of these sites have missions that you will believe in, and you are going to have to make sure that you are going to pick out the company. This will help keep the platform alive, but that means that people are going to have to do some research to make sure that they are going to be lending to the right people.

Everyone who wants to invest on an investment platform needs to make sure that they are going to get better results by making sure that they have picked the right place to go. People that do not feel safe will not invest, and the crowdfunding industry is going to have to do some work to help make people feel as safe as possible when they are lending.

The peer-to-peer loan does not work without a bank

All P2P lenders cooperate with a bank because it is regulated by law that only a credit institution with a full bank license is allowed to carry out banking transactions. The partner bank in the peer-to-peer loan is responsible for the transfer of money between the lender and the borrower.

As a rule, the bank charges for this a small percentage of the loan amount as a origination fee paid by the borrower.

Advantages and disadvantages of P2P finance

Advantages

- High returns.

- Flexible maturities.

- Start investing from 10 Euro is possible

- Possible investment in a large number of personal loans.

- Largely transparent and self-selectable portfolio.

- Individually controllable.

Disadvantages

- Default risk.

- Erroneous assessment of the borrower's good credit worthiness.

- Insolvency of the P2P site.

Failure Risk: What happens if a peer-to-peer loan fails?

So is Peer to Peer lending safe?. The P2P platforms promise some measures to mitigate the risk. In a first step, the platform will contact the debtor and try to find out why he did not pay. If this does not work, a reminder is issued by the intermediary partner bank. If the debtor still does not pay, the termination of the loan as well as the efforts of a collection agency follows.

The collection procedure is between the bank and the borrower. As an investor, you have no opportunity to contact the defaulting debtor, he remains anonymous. However, many platforms offer good transparency as to what stage the collection process is currently in progress, so that you can find out what your money is going on.

Particularly in view of the fact that P2P personal loans are mainly used by borrowers who have little or no chances in the traditional credit market, the risk of default in P2P lending must not be underestimated.

What happens if a P2P platform goes bankrupt?

A second, big risk is the platform itself. If the platform goes bankrupt, your capital is also inevitably gone. Many P2P platforms are relatively young and not yet on the market for very long. This means that they have little equity and can quickly become victims of bankruptcies.

When the platform publishes financial reports or statistics on their growth, lending volume, investors and default rates on its website, you should track the figures to assess the risk of bankruptcy.

Top 3 tips for your peer-to-peer investment strategy

From the risk of credit loss and the risk of platform players, the most important rules for investing money in P2P loans are also derived:

- Scatter the risk: This means that you should never invest your capital in just one project. The best is high diversification with small amounts. If a loan fails, the loss will be worsenable by the relatively small sum.

- Do not put all the eggs in one basket: invest on several P2P lenders. If a platform fails, you will not lose all your capital.

- Be patient: Especially if you invest many amounts as recommended, your investment needs time to develop. Give yourself this time and invest in a long and secure perspective rather than risk a lot in the short term.

The taxation of P2P interest income

There is still a pitfall that you absolutely need to know about peer-to-peer loans: Taking. Unlike, for example, stock profits, the withholding tax is not automatically withheld. As an investor, you are responsible for taxation of your profits from P2P loans and must prove the interest payments from each individual loan you have invested in.

Some platforms offer the compilation of all interest income as a service, while others require you to determine and sum up the income yourself.

When you decide to invest in small business loans, you should always consider the risk of default. The amount of money you invest in P2P loans ultimately depends on your total assets. In general, we recommend investing only sums where you could lose a total loss.

Popular Blog Posts

Here are some popular blog posts for investors:

How Much Do You Make With P2P lending?

Transparency: The Cornerstone of P2P Lending

P2P Lending Blogs

Here are some other blogs you should include in your repertoire

Forums

Here are some important places to get info and interact with other investors.

Global P2P Lending Forum (Global)

Must Read Books

For a more in depth look at the world of peer to peer lending. Here's a list of recommended reading - all available through Amazon!

Breaking Banks: The Innovators, Rogues, and Strategists Rebooting Banking

The End of Banking: Money, Credit and The Digital Revolution

Regulation

Commission proposal for a regulation on European crowdfunding services providers (Europe)