-

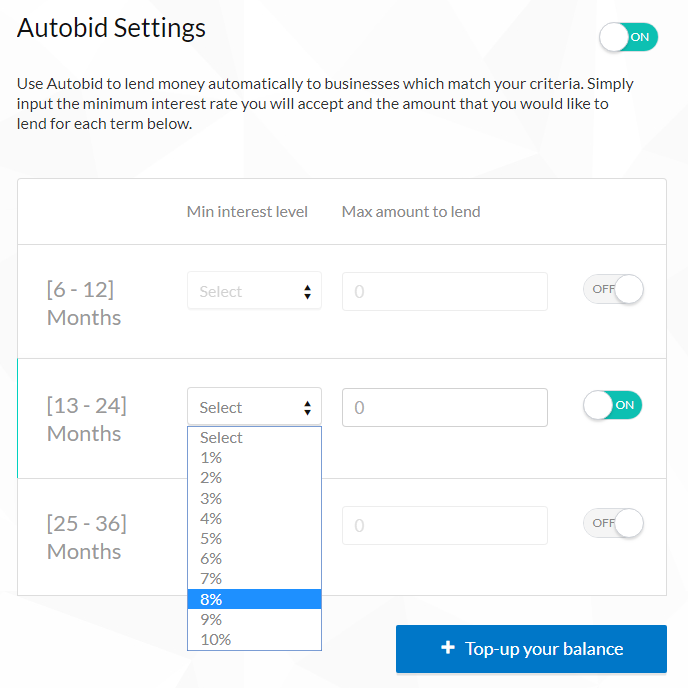

canythould43 added a new photoFlender.ie Autobid is a mechanism by which we can automatically lend money to companies that fit our time and profitability horizon .

For each range of loan duration we can choose the minimum return that we are willing to accept and the amount we want to invest. -

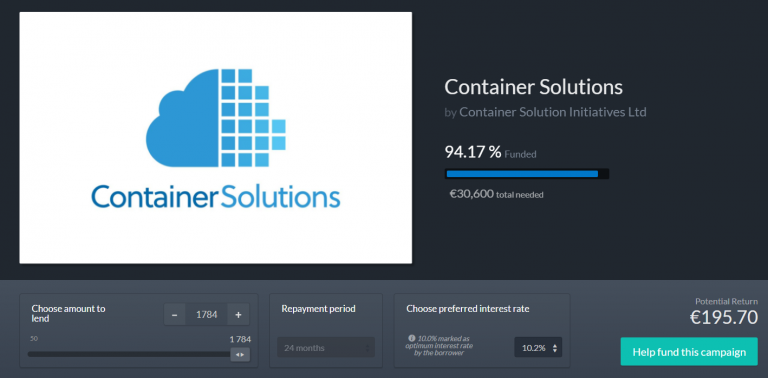

canythould43 added a new photoIn this detail screen of the loan, we can consult detailed basic information of the project and choose the amount that we are going to contribute to it, as well as the interest rate that we are going to request (normally we will choose the maximum possible that is preset).

-

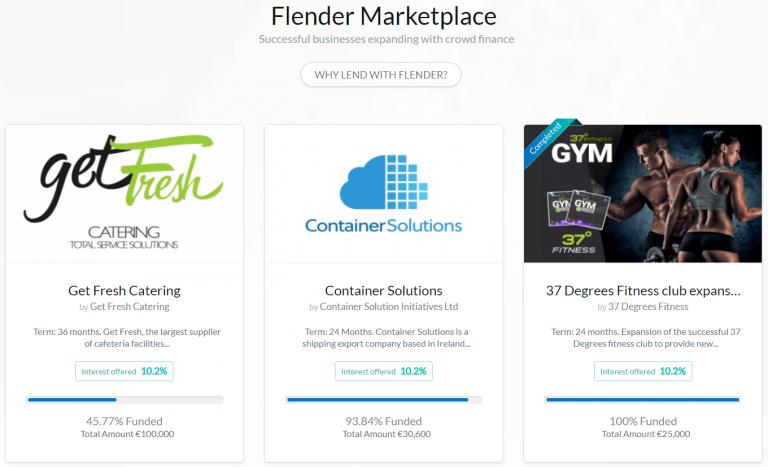

canythould43 added a new photoThe Flender Marketplace, accessible from the Dashboard is the screen that offers us the projects available to invest at that time, with the interest rate they offer us, the duration of it in months (term) and the % of loan covered at that time.

-

canythould43 added a new photoRegistration in the Flender investment platform is similar to the process that we can follow in other European crowdlending marketplaces.

-

-Investors receive notification when a new loan listed on the market.

- Can be funded by bank transfer / instant debit card.

- No buyback / No Secondary market.

- Monthly repayment most of the loan with some slightly longer repayment in between.

- Minimum investment is 50 Eur. -

canythould43 added a new videoeview of the Business Crowdfunding Platform FlenderReview of the Business Crowdfunding Platform Flender ▶ Check out my review of Flender: https://marcoschwartz.com/flender-review In this video, I'll tell you about the business crowdfunding platform Flen ...

-

canythould43 posted a new discussion Already invested in Flender?Already invested in Flender? If so, share your impressions below. Are you happy with Flender Have you encountered an issue that other investors shoul ...

-

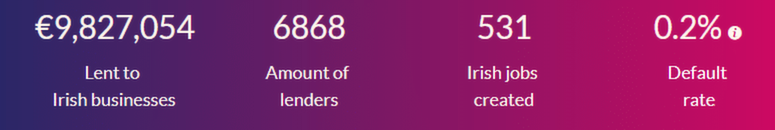

With a community of almost 4,000 investors and average historical returns exceeding 10%, Flender is a very competitive and highly recommended platform to complement our crowdlending portfolio.

-

-

Although the platform has a very limited geographical scope (Ireland), In this case is a great strength for two reasons:

1) Irish companies have zero loan default rate (they are much more reliable than average).

2) This is the only platform on which you will be able to obtain exposure to the Irish country for yout entire portfolio (not even Mintos offers Irish loans). -

Flender is a great P2B crowdlending platform (loans from individuals to companies) focused on Irish SMEs with net returns of around 10% and absence of failed loans, ideal for geographically diversifying your Peer to Peer investment portfolio.

Flender is an Irish-based company that acts as a marketplace to connect solvent Irish companies that need financing with private investors looking to get an interest for their savings. -

canythould43 posted a new linkIrish P2P lending company Flender has raised €75 million in a funding round in a bid to provide enhanced loan services to its Irish businesses. The FinTech has also slashed its borrower interest rates up to one percent across all of its loan products. Previously offered with an interest rate of 7.5%, the loans of up to €250,000 will be available from 6.45 percent for terms up to 36 months.Irish LendTech Flender raises €75 mn to boost SME loan offerings https://ibsintelligence.com Flender has raised €75 mn to provide enhanced loan services to its Irish businesses and has slashed its borrower interest rates up to one percent acro ...

-

canythould43 added a new photoFounded in 2015, Flender has loaned almost €10 million to date and has almost 7000 investors.