-

canythould43 a répondu à Already invested in RoboCash?Robocash have reduced the supply on the platform. For this reason, not all of the money may be invested. New loans of different terms are available a

-

Outlawking a répondu à Already invested in RoboCash?Ok but not very diversified I have been using for over a year. Very good platform, some delays but less than other platforms and interest is paid on d

-

Thunderbolt a répondu à Already invested in RoboCash?Good idea to invest the savings that produce almost nothing in the bank, with a secondary market to sell in case of need that works very well, the int

-

canythould43 a répondu à Already invested in RoboCash?Robocash has not yet obtained any licence related to investment brokerage and is located in Croatia, where platforms such as Credon and PeerBerry have

-

canythould43 a répondu à Already invested in RoboCash?The P2P lending platform Robocash announced that it would be lowering the interest rates for the following loan terms: 10.5% (91 - 180 days), 11% (181

-

Olga Davydova a ajouté une nouvelle photoThe European P2P platform Robocash has summed up the results of the past year. They demonstrate a growing interest in using the platform: the number of investors doubled compared to 2017, and the total volume of attracted investments reached €5 million.

Read more:

https://robo.cash/news/robocash_sums_up_the_results_of_2018 -

canythould43 a démarré une nouvelle discussion Changes in the Loyalty programRobocash decided to revise the terms of the Loyalty program and make changes to regulate the demand on the platform. According to the new conditio ...

-

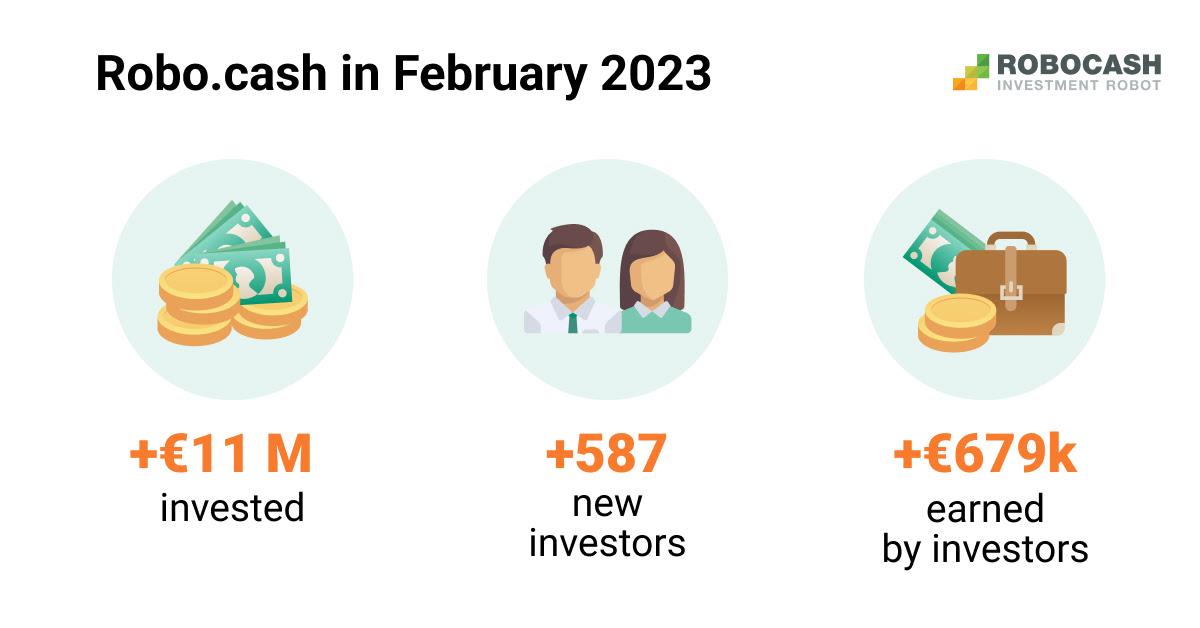

canythould43 a démarré une nouvelle discussion Robocash is lowering interest ratesOn February 8, 2023, Robocash is lowering its loan interest rates for terms ranging from 91 days to 3 years. Investors will be able to earn 12% APY ...

-

-

canythould43 a démarré une nouvelle discussion Investors on Robocash are currently experiencing cash dragThe availability of loans on Robocash is low, causing cash drag for investors who wish to deploy their funds. ...

-

canythould43 a posté(e) un nouveau lienRobocash Group has released the audited special purpose consolidated financial statements for the years ended December 31, 2022 and 31 and December 31, 2021. The report features Robocash PTE LTD and its subsidiaries, located in Central Asia, Europe and Asia Pacific Region.Robocash group https://robocash.group No description

-

canythould43 a ajouté une nouvelle photoIn accordance with current business needs, Robocash have reduced the supply on the platform. For this reason, not all of the money may be invested. New loans of different terms are available a few times a week. When setting up portfolios, Robocash recommend that you choose originators from Spain, Singapore and the Philippines first, as they provide more new loans.

-

Performance of loan originators in 2022

Digido, the Philippines

Digido became part of the Fintech Alliance.PH, the largest financial technology and digital player association in the Philippines. 2022 was also marked for the company by other results:

Loan issuance increased by 35% compared to 2021.

The number of repeated loans increased by 79%.

Net profit showed growth of 16%. -

Performance of loan originators in 2022

UnaPay, the Philippines

In 2022, the focus of our Una team in the Philippines was to shape the company's strategic vision. Among other things, currently the company aims to:

add new merchants (Kimstore, Emcore),

update the mobile app. -

Performance of loan originators in 2022

RC Riga Sri Lanka

The business began to fully develop in 2022.

The issued principal for Q4 exceeded the figures for Q4 2021 by 7 times.

The share of overdue loans is maintained at 11,5% FPD 60+, which indicates growth in the quality of borrowers. -

Performance of loan originators in 2022

Prestamer.es, Spain

Overall growth for 2022 was +5% thanks to:

overfulfilling the plan for repeated customers by 15% in November,

systematic growth of portfolio in October. -

Performance of loan originators in 2022

RC Riga Singapore

The Singapore loan originator is raising funds for the development of the Robocash Group's business model. Among other things, these are:

business support in Vietnam: in 2022, loan issuance here increased by 53% compared to 2021,

planning new product launches in Africa and Latin America. -

Performance of loan originators in 2022

RC Riga Kazakhstan

2022 turned out to be a very dynamic year for the company. After February, business in Kazakhstan was able to increase the volume of loans through its own financing, maintaining leadership in the Kazakhstan PDL market:

Net profit exceeded the planned figure by 2.5 times.

The company maintains a consistently high customer loyalty index of 82%.

Loan issuance increased by 60% compared to 2021. -

canythould43 a ajouté une nouvelle photo dans l'album du groupe Robo.cash - News & Feedback's Photos

-

-

Robocash lowers interest rates

The P2P lending platform Robocash announced that it would be lowering the interest rates for the following loan terms: 10.5% (91 - 180 days), 11% (181 - 365 days), and 11.5% (366 - 720 days). Please note that the lowest (8%) and the highest (13%) rates remain the same. The updated interest rates will apply to new investments made from December 21. -

canythould43 a ajouté une nouvelle vidéoDarum ist Robocash erfolgreich! (Robocash P2P Lifestyle Part 7/7) Hier gehts zu Robocash ►► https://bit.ly/community-goes-robocash * [1% Cashback] Hier gehts zum Beitrag ►► https://bit.ly/robocash-moskau Abonniere JE ...

-

ROBO.CASH has revealed that it doubled its lending volumes in 2019 from the previous year, boosted by an influx of new investors. The European peer-to-peer lender, which is headquartered in Croatia, said that it financed €80m (£68.6m) of loans in 2019 – double the amount it lent out in 2018.

-

canythould43 a démarré une nouvelle discussion Already invested in RoboCash?Already invested in RoboCash? If so, share your impressions below. Are you happy with RoboCash? Have you encountered an issue that other investors ...

-

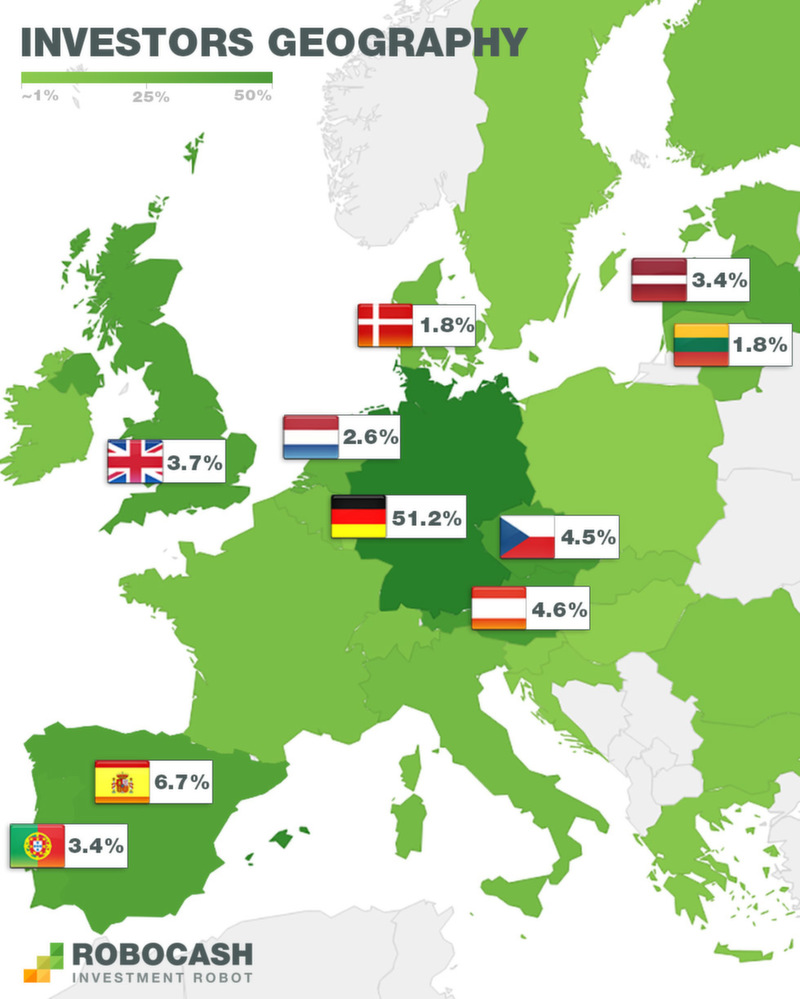

canythould43 a ajouté une nouvelle photoRobocash is a company that has been operating since 2010 but was presented in February 2017 to European and Swiss investors. It is a Crowdlending company that is part of the Holding RoboCash Group which is a financial group of companies founded in 2013, with more than 6.8 million registered customers, with more than 1600 employees, a group that has already lent 4 , 3 million loans with a volume exceeding 400 million dollars.

-

If we add to this automation philosophy the fact of the high profitability that they offer (in the environment of 12% interest) and that all the available loans that we find in Robo.cash come with Buyback or buyback guarantee , we have all the ingredients to This Croatian website is an attractive option for the vast majority of crowdlending investors.

-

This automation, especially for those who start in the world of P2P loans, can undoubtedly be an interesting advantage , since they will not have to make decisions about choosing the assets to invest in if they do not want to.

-

canythould43 a ajouté une nouvelle photoRobocash is an automated investment oriented platform, that is, designed so that the system is automatically responsible for choosing the loans in which we invest based on simple parameters that we configure in the AUTOINVEST tab.

-

It is necessary to emphasize that it is guaranteed that all commitments on the sold loans of Robocash Finance Corp. on the platform will be fulfilled. All the invested funds including the earned interest will be paid back to investors in due course set by the existing assignment agreements.

-

On 19 December 2019 Securities and Exchange Commission in Philippines (SEC) has issued a press release that it has stripped Robocash Finance Corp.’s (Company) authority to operate as a financing company for running several branches without the necessary license.

-

-

Olga Davydova a ajouté une nouvelle photoThe European peer-to-peer lending market preserves the increase of volumes and the growing interest in the investments of this kind, that is supported by the results of the fully automated investment platform Robo.cash in the first quarter of 2018: as compared with the fourth quarter of 2017, the number of investors increased by 44% and the volume of financed short-term loans grew by 18%. Read more: https://robo.cash/news/robocash_outlined_results_in_q1_2018

-

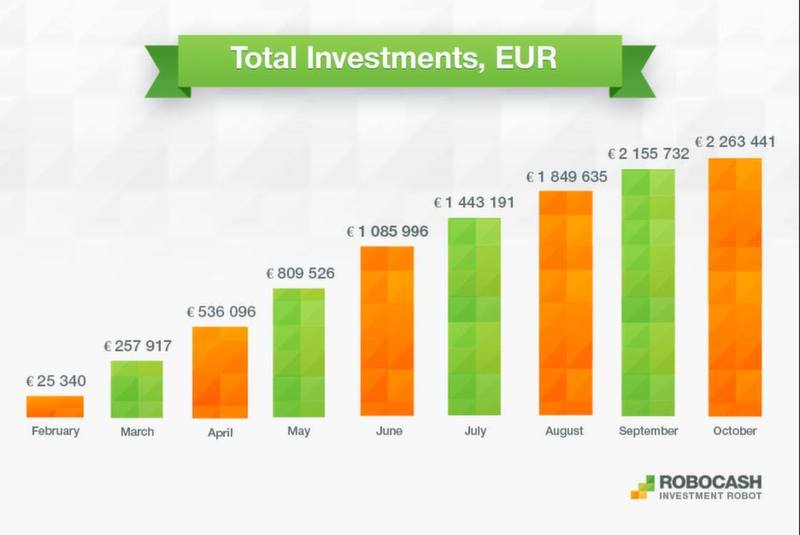

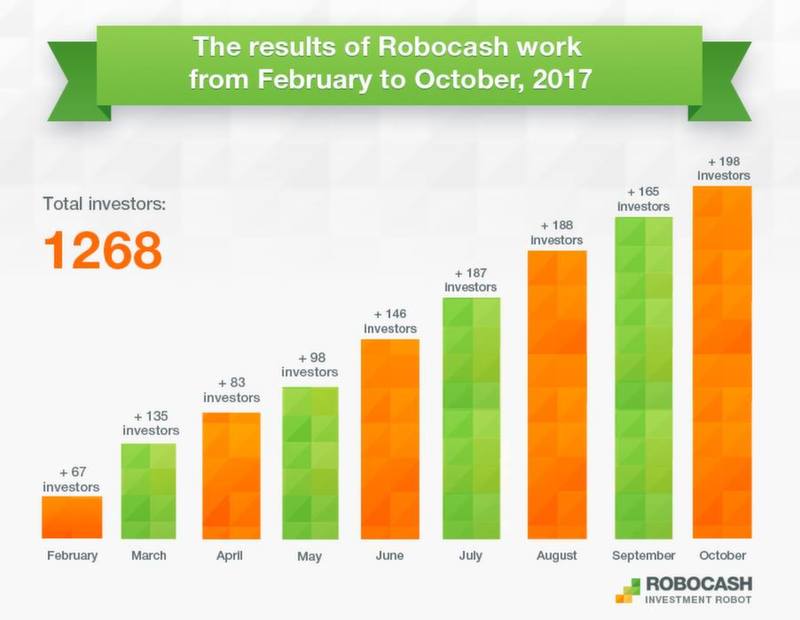

Olga Davydova a ajouté une nouvelle photoThe investment service Robo.cash outlined the results of the first year in operation on the European P2P lending market: 2.000 investors from the EU and Switzerland invested over €3 million in the issue of 330 thousand short-term PDL-loans in Kazakhstan and Spain. The results and the platform dynamics are considered to prove the growing demand for complex automated solutions in the global alternative fintech. Find out more: https://robo.cash/news/robocash_outlines_the_first_year_results

-

Olga Davydova a ajouté une nouvelle vidéoAppeal to investors from Sergey Sedov, the founder of Robocash platform Sergey Sedov is telling about Robocash P2P platform. Robocash provides with an opportunity to invest in short-term loans with 14% income annually. The ...

Robocash have reduced the supply on the platform. For this reason, not all of the money may be invested. New loans of different terms are available a few times a week.