-

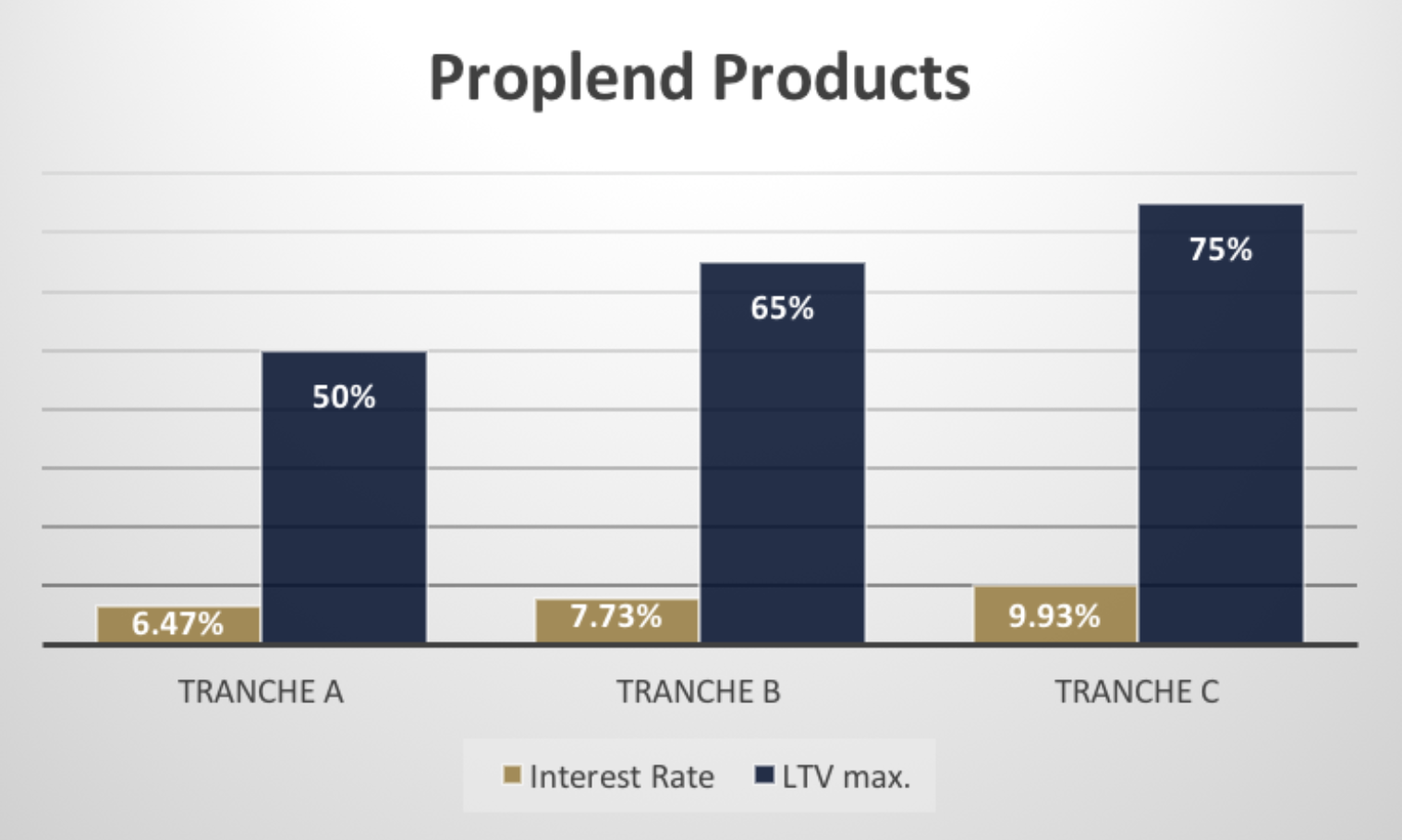

Proplend's auto-lend product spreads investor funds across multiple loans and is only invested into 'A' tranche loans, where the maximum LTV is only 50%. Proplend has a good lending track record making this one of the safer P2P options.

-

Proplend Ltd is approved and supervised by the Financial Conduct Authority and entered in the Financial Services Register under company registration number 726646. The platform was introduced by a team of experts in 2014. The CEO is Brian Bartaby, who has a very good experience in financial products and real estate investment. IFISA was launched by Proplend in 2017.

-

Proplend* does secured property lending in the UK, usually to landlords of residential properties or commercial properties such as shops, business parks and hotels. These loans are most typically for 36 months. It also arranges some short-term property (bridging) lending, such as loans to acquire land for property development. However, it doesn’t do loans to actually develop properties. These loans are for 12 months or less.

-

canythould43 a ajouté une nouvelle vidéoproplend - crowdfunding Earn 5-12% p.a.* Income is taxable. Reinvest monthly income or withdraw cash. *Return after fees, before bad debt. Not covered by FSCS - capital at ri ...

-

canythould43 a posté(e) un nouveau lienOnline platform Proplend gave its 2018 peer-to-peer (P2P) property lending year in review. The lender listed the various accomplishments that the lending industry experienced in the past twelve months.Proplend Looks Back on 2018 & Announces 2019 Plans https://www.crowdfundinsider.com Click HERE to find out ⭐ Proplend Looks Back on 2018 & Announces 2019 Plans. | Crowdfund Insider: Global Fintech News, including Crowdfunding, Blo ...

Il n'y a aucune discussion dans ce groupe. Pourquoi ne pas en créer une ?