Peer to Peer Lending Vs Stocks

- Taille du texte: Agrandir Réduire

- Lectures : 43362

- 2 commentaires

- Notifications

Peer-to-peer lending, or most-commonly known as P2P lending, is a financing method that matches individuals and businesses who need to borrow money with others who want to invest their money without the need for any financial institution as an intermediary at an agreed fixed interest rate.

The main idea and attractiveness of peer to peer lending vs stocks is that investors get higher returns by lending their money rather than saving it; and borrowers get funds at a lower rate than traditional financing methods.

The entire process is conducted online through a number of peer to- peer lending sites or platforms. The basic function of the P2P lending platforms in long term investment is to connect borrowers with willing lenders.

In addition, the peer-to-peer lending sites perform all the credit and background checks on the potential borrowers in a pre-qualification process; and when approved, all borrowers are presented to investors to choose from.

The pre-qualification process differs from one site to another, but they are generally based on the borrower’s credit score, income, work history, and education. Peer-to-peer lending sites usually charge the investor an investor’s fee in the range of 1% of the amount borrowed and the borrowers an origination fee of 1%-5% depending on their credit rating.

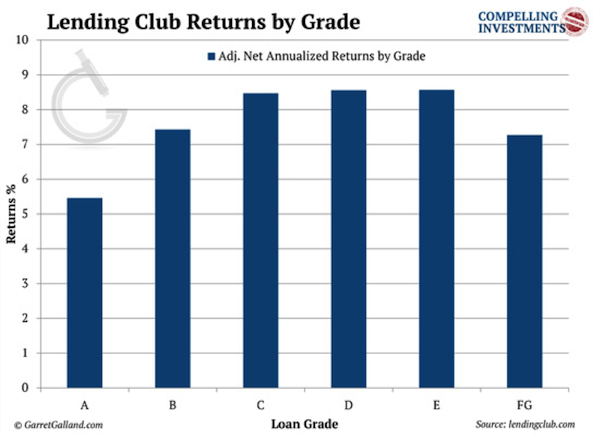

Peer-to-peer lending platforms are capable of generating annual return rates between 8% and 10%.

Related: How Much Do You Make With P2P lending?

P2P Lending: Useful as a Stock or a Bond

One of the biggest threats that faces your investment portfolio is the volatility associated with its components as it can destroy your profitability in the short term. Therefore, it is important to diversify the investments in our portfolios with assets that are de-correlated because when volatility increases and the markets correct, your portfolios will remain fairly dignified.

For that reason, adding investment in bonds to investment in stocks is a shrewd strategy. Although bonds tend to give lower returns, their volatility is much lower and their returns can be considered fairly guaranteed.

To further reduce your portfolio’s exposure to volatility, an investment in P2P lending platforms in long term investment can help in achieving that goal, as has historically been the case of fixed income or gold; albeit investing in peer to peer business loans can give higher returns than fixed income or gold; with even lower volatility.

When comparing P2P lending vs the stock market, although they offer less liquidity, their returns are higher and volatility is lower.

P2P Lending is Still a Remarkable Investment

By investing in P2P lending platforms in long term investment, an individual basically offers his/her money for people to borrow. Peer-to-peer investing can be a rewarding investment as investors usually earn higher p2p lending returns than the saving accounts offer.

However, as any form of investment, P2P investing comes with its own risks in the form of loan defaults; yet, these risks can be mitigated by the investor through perfectly crafting a mixed portfolio of borrowers.

Therefore, due to the current ultra-low interest rates offered on saving accounts, P2P investing is considered to be a remarkable investment.

How risky is p2p lending Compared to Dividend Investing

While P2P lending offer higher returns, they also expose the investor to higher risks. With P2P lending investing, the investor invests in a relatively unknown borrower who might default on the loan versus a well-established corporation as with the dividend yields.

Most p2p lending platforms and marketplaces provide unsecured personal or business loans, meaning there is no collateral to back the loan. The platforms use an extensive analysis of each person and business that applies for a loan taking into account many factors the likes of monthly income, are they homeowners or not, debt history, credit card payment history,….etc.

By analyzing these factors they create a risk profile and based on that they decide if the applicant gets a loan and for which interest rate.

High-risk loans offer investors high-interest rates but at the same time, they have a high chance of defaulting (meaning the borrower doesn’t pay back the loan). As there is no collateral this can mean that an investor loses his invested/lent money. By diversifying your loans over many different loans with varying risks you can lower your risk…and this is what most investors do.

When the international P2P lending platform Mintos entered the market they decided to offer secured loans. Up to that moment, this had not been done on a large scale yet in the P2P lending market. And Mintos therefore, created a great new addition to these loans.

100% Buyback guarantee secured loans will net you, as an investor, less interest than unsecured loans, but it will greatly reduce your risk as Mintos will buy back the loan whenever the borrower defaults on his payment obligations for 60 days or more. In such a situation the loan is automatically bought back by the loan originator from the investor at the nominal value of the outstanding principal, plus accrued interest income.

This is a great system that greatly reduces your risk as a lender.

Other p2p investing site which offer buyback guarantee in its Terms and Conditions is PeerBerry.

Related: International P2P Lending Sites - Full List.

How Peer to Peer Lending Fits with Stocks and Bonds

Being considered an independent performer; together with its low volatility, demonstrate an almost total de-correlation of peer to peer lending with the rest of the market; including stocks and bonds. This makes P2P lending a perfect fit in your investments’ portfolio with stocks and bonds.

When comparing bonds vs P2P loans, it is agreed that bonds represent one of the most solid forms of fixed income investment; however, their yields are not on the highest end. On the other hand, P2P lending are still considered a low risk investment and offers more diversification opportunities and higher rates.

On the other hand, when comparing lending club vs stock market, the former is considered as both a stock and a bond as you can either invest in the company’s stock itself or invest in a portfolio of its peer to peer loans.

In conclusion, investing in P2P loans offers a lot of advantages; including:

- Achieving p2p lending returns that are high enough and more adjusted to risk than the classic portfolio of stocks and bonds;

- Providing less volatility;

- When you lend you are the first one that charges and you get the partial return which enables you to reinvest each one of the loan installments and increase your profitability.

Are Dividend Yields Better Than Peer-To-Peer Yields for Income Investors?

Comparing P2P investing with other forms of financial investing highlights the benefits of the former and why it should be considered by every income investor.

First, when looking at the dividend yields, although they are considered to be one of the least risky forms of investment, it tends to offer less returns than stocks and P2P investing.

When investing with one of the most established P2P lending platforms in long term investment, the average P2P lending return is in the range of 8%-9% versus an average dividend yield of 6%-7% on well performing stocks.

However, the main advantage of dividend yields over P2P investing is that the former is a form of long-term investment with a potentially increasing return while the latter is a short-term investment with a fixed return.

How much to invest in P2P Lending?

Due to the decorrelation between P2P lending investment and both stock and bonds, it is often advised to invest in P2P lending as much as 20% of your investment portfolio in peer to peer lending. However, and depending on the size of your portfolio, 10% investment in peer to peer lending is considered to be the minimum.

Problems that Stop People from Lending Money Online

As with all forms of online dealings, investing in P2P lending means that you do not actually know who you are dealing with. This idea deters a lot of people from investing their own money in Peer-to-Peer lending.

However, with certain strategies of how to invest in P2P lending, this risk can be highly mitigated.

First, there are certain borrower’s credit rating criteria that an investor should focus on; such as: home ownership and stable job which reflect stability and dependability; and debt to income ratio, high income and no credit inquiries which reflect their financial soundness.

Second, by diversifying the loans’ portfolio over different credit grades and of different amounts, the investor will diversify his sources of return and lower the risk of defaulting from one of them.

Saving for Retirement Changes with Age

Younger people tend to take more risks as they think they still got many opportunities ahead; however, as people get older, their tendency of taking risks becomes lower as losing your savings at an advanced age is a big problem. Consequently, people are advised to invest their money when they’re young, and then shift to protecting their savings as they grow older.

These trends draw young people more towards investing in peer to peer lending vs stocks, but as they grow older their investment preferences shift to a safer form of investment.

Commentaires

-

jeudi, 10 janvier 2019

jeudi, 10 janvier 2019Stocks and Mutual Funds are generally for mid to long-term as you get more time to cover losses that may incur with your investments during this time.

P2P lending work in a different way and the investment varies between 1 months to 24 months.

If you need funds in a shorter time and does not want to lock your money for a long term, P2P lending turns out to be a better investment choice.

Where would you recommend to invest, stocks, funds or P2P lending?