-

canythould43 ha iniciado una nueva discusión Lendermarket portfolio hits €50mLendermarket has reported that its platform’s portfolio has reached €50m, thanks to “rapid growth” over the ...

-

canythould43 ha iniciado una nueva discusión New function on Lendermarket's platformLendermarket announced the upgrading of their marketplace investor dashboard and increased transparency of how investors' funds flow to and from lo ...

-

canythould43 ha iniciado una nueva discusión Conor Gibney is the new CEO at LendermarketLendermarket announced a new CEO, Conor Gibney, who previously worked as the CFO at Lendermarket. ...

-

canythould43 ha añadido un nuevo vídeoInvest in consumer loans with Lendermarket and earn great returns online! Lendermarket is a cross-border P2P investing marketplace for European consumer loans. We offer you fair return on investment, mitigated risk managemen ...

-

Interest rates are currently between 12%-16% (although they tend to fluctuate). Most loans are short-term personal loans. All loans have buyback guarantees, including a group guarantee (i.e loans are guaranteed by both the issuer and the group). Loans are available from Czech Republic, Finland, Poland, Spain, and Estonia, Sweden and Denmark. Most loans appear to be coming from Creditstar Spain and Poland currently.

-

The auto-invest function has all the usual options found on other sites. This includes country, loan term, interest rate, and loan originator. Lendermarket provides investors a weekly email that provides simple information about interest earned, principal received from investors, investments made, and cash held on their behalf. The site has good reporting functionality, allowing investors to see all activity on their account within a chosen time period, and it can generate statements.

-

SA Financial Investments OÜ owns Lendermarket Limited OÜ – an Estonian holding company that is, in turn wholly owned by Mr. Aaro Sosaar - the CEO of Creditstar Group. He is the ultimate beneficial owner of Lendermarket Limited. Lendermarket’s office is in Estonia, where the core team is located.

-

-

Lendermarket is a peer-to-peer (P2P) lending marketplace that lists short-term loans between 30 days and 53 months and interest between 9% and 16% per annum. A 60-day buyback guarantee secures all loans. The minimum deposit is only 10€, and you can diversify your investments across seven countries.

-

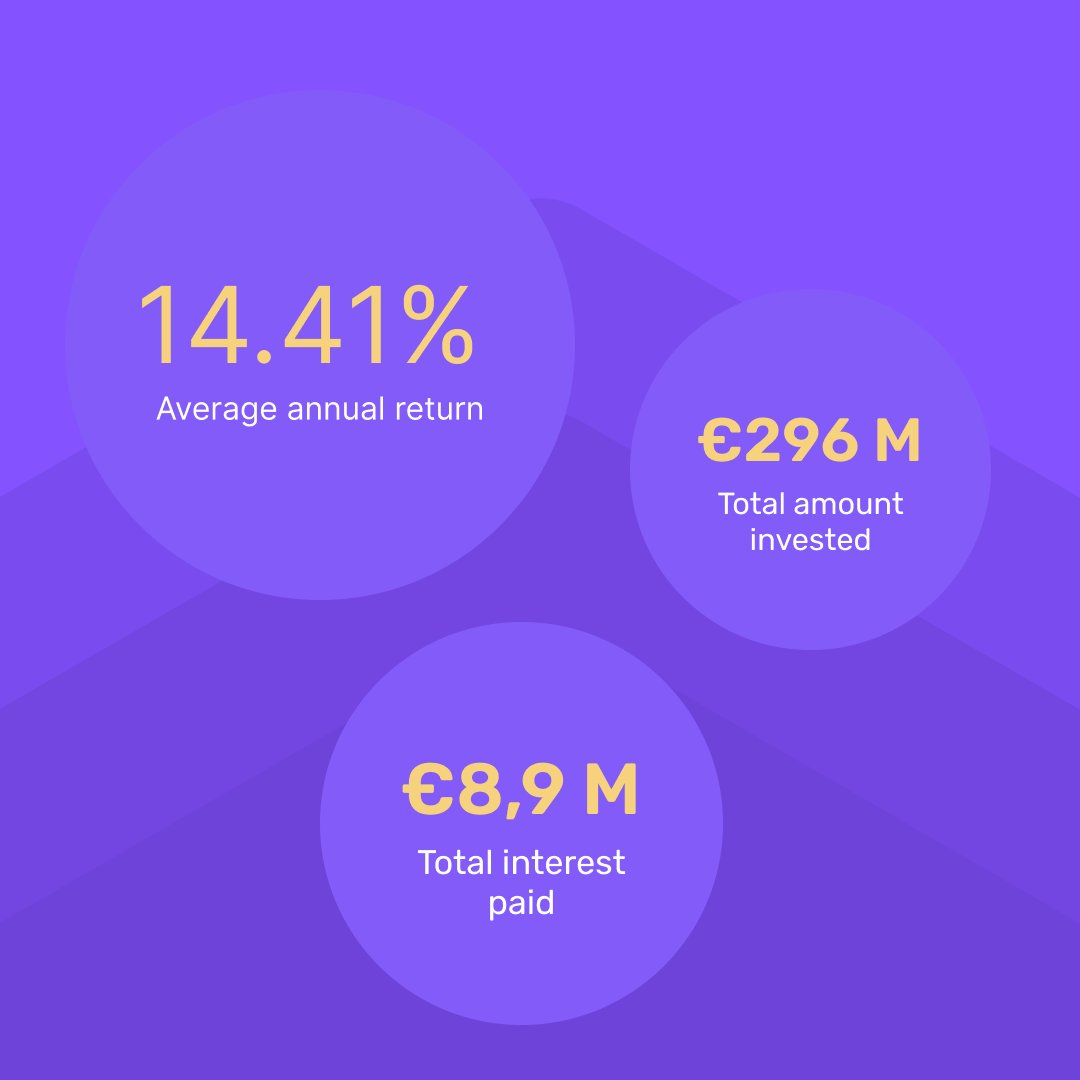

canythould43 ha publicado un nuevo enlaceYear In Review! | Lendermarket https://lendermarket.com No description

-

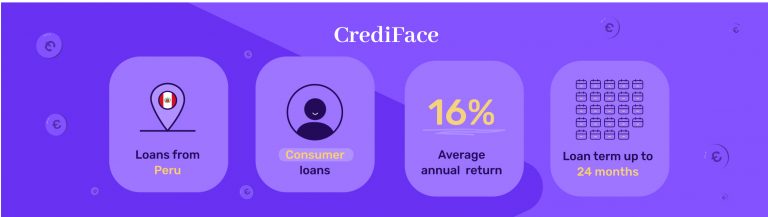

canythould43 ha añadido una nueva fotoWelcome to Latin America! Meet the newest Lendermarket loan originator @CrediFacePeru.