-

canythould43 ha iniciado una nueva discusión Bondora actively working on scaling loan services across EuropeBondora’s chief executive has revealed that the European peer-to-peer lending platform is looking to expand into new markets and products ...

-

canythould43 ha iniciado una nueva discusión Bondora sees Netherlands monthly originations surpass €1m for first timeBondora reported a dip in loan originations in May across all markets except the Netherlands, which more than doubled to over €1m for the ...

-

Bondora decreased the interest rate to 4%

New investors on Bondora, who wish to earn interest with Go & Grow are only able to use the "Unlimited" product, which generates 4% per year. Existing investors will continue earning 6.75% with the traditional Go & Grow product. -

Go and Grow limit has been increased to €700 per month

Bondora has increased the maximum investment amount for "old" Go & Grow users to €700 per month. -

P2P lending service Bondora* has announced that in future it will focus completely on its hands-off investing product Go&Grow. From February 27th, the products called Portfolio Pro and Portfolio Manager will be discontinued. These allowed investors to select into which individual loans they wanted to invest.

Bondora originally started and grew big with investment into individual loans and only 2018 introduced the simplified Go&Grow product which soon became very popular. Over the years Go&Grow became more and more important for Bondora as investors seemed to prefer the easy to understand product with a fixed interest rate. -

Creative accounting, paid reviews, high affiliate commissions, bad portfolio quality, takes fee from recovered debt.

-

Being a P2P lending platform, and the fact Bondora havent survived a major financial crisis, the risk is fairly high. Adding on top of that the no buy-back guarantee and you have a high risk somewhat high return asset.

-

Once you have funds in your account, you get presented with three options. The options are Portfolio Manager, Portfolio Pro and Go & Grow, which determines the way you want to invest in P2P loans.

-

-

Once you sign up for an account and have provided proof of identification, you simply add funds to your account and get started with investing in consumer loans.

You can add funds in various ways:

-Credit card

-Transferwise

-Direct bank transfer -

They focus on unsecured consumer loans with principal amounts of €500 to €10.000 and repayment terms ranging from three to 60 months. In 2014 the UK Financial Conduct Authority (FCA) grants Bondora an interim license and in 2016 it gets licenced by the Estonian Financial Supervision Authority (FSA) as a credit provider.

-

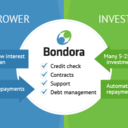

Bondora issue the loans themselves through their parent company Bondora AS, which retains a share of the risk in each loan. The platform basically distribute shares of loans to investors, giving the borrowers below market rate loans and providing the investor with a much needed higher rate of return on investment.