-

canythould43 ha respondido a Already invested in Bondster?Bondster's loan originators don't honor the buyback guarantee

-

canythould43 ha iniciado una nueva discusión Bondster rewards investors for recommendationsBondster is offering users a one per cent bonus if they refer friends to the platform and they start investing. Once the friend activates their ...

-

canythould43 ha iniciado una nueva discusión Rapicredit's remaining debt of €313,000 will be repaid by the end of October 2023Bondster announced that the Colombian lender Rapicredit didn't fulfill the promise to repay all outstanding debt to investors by the end of June 20 ...

-

Bondster’s most significant strategic partner is ACEMA, a loan originator from the Czech Republic. ACEMA is an established lender that also listed its loans on Mintos in the past.

-

canythould43 ha publicado un nuevo enlaceThe investment platform Bondster has reached 16 thousand users who have earned over € 5,3 million in interest - Bondster │ Bondster https://bondster.com No description

-

Bondster presents a new fully liquid investment product. Maximum liquidity and an attractive interest of 3.9% p.a. Both new and current clients can now invest in the product called the Profitable Reserve, which yields the highest possible interest in terms of liquidity and risk ratio.

-

canythould43 ha iniciado una nueva discusión Already invested in Bondster?Already invested in Bondster? If so, share your impressions below. Are you happy with Bondster? Have you encountered an issue that other investors ...

-

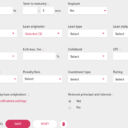

On Bondster retail and company lenders can invest money, if they have got a banking account withing the European Union (plus Norway and Switzerland). CZK (Czech Krona) and Euro are available for investments at the moment.

-

-

Bondster is fully owned by the Czech investment company CEP Invest Private Equity. Bondster attracts investors from the whole EU. But you also have loans in CZK currency appealing to local investors in the Czech Republic.

-

The biggest advantage is definitely high returns on loans. Moreover, these loans are either secured (by real estate or movables) or offered with a Buyback Guarantee (in case the debtor does not repay the loan, the provider has to buy it back from the investor) which eliminates the risk for investors.

-

Investors can also see the repayment history of the debtor to whom the loan had been provided and they can also see the basic information about the debtor.

-

Bondster is one of the fastest growing fintech companies in the field of P2P (Peer-to-Peer) loan marketplaces in Europe and the very first online investment platform of its kind in the Czech Republic.

-

canythould43 ha añadido un nuevo vídeoJosef Donát (Rowan Legal) about P2P investing on BondsterJosef Donát (Rowan Legal) about P2P investing on Bondster Jana Mücková, economist of P2P marketplace Bondster, interviewing Josef Donát, partner of the law firm Rowan Legal.

Bondster's loan originators don't honor the buyback guarantee