-

As with most other peer-to-peer lending platforms, there is no buyback guarantee in the event of project failure. This type of insurance project is mostly used by credit originator platforms because transparency is very poor and investors need some kind of protection (even if it is weak) to be interested in this type of a company.

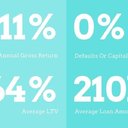

At Landlordinvest, loans are given a credit rating based on collateral and the downside to not getting a buyback guarantee is that investors need to exercise due diligence and look at particular ventures as well as take diversification seriously. It is suggested to have over 100 loans to ensure good diversification. -

LandlordInvest mostly does residential bridging loans, but also some commercial-property bridging (e.g. loans against pubs and hostels), and residential buy-to-let lending. It also sometimes covers the final costs for completing residential developments. Loans are typically between £50,000 and £500,000, lasting about one year.

-

canythould43 posted a new linkInterview with our CEO, Filip Karadaghi | LandlordInvest https://landlordinvest.com P2PMarketData, a European peer to peer lending comparison site, has published an interview with our CEO, Filip Karadaghi, discussing LandlordInvest's ...

-

canythould43 added a new videoLandlordInvest Crowdcube FinalLandlordInvest Crowdcube Final No description

-

canythould43 posted a new linkLandlordInvest, a peer-to-peer lending platform for residential and commercial mortgages, is now seeking a minimum of £300,000 through its equity crowdfunding campaign on Crowdcube.P2P Lending Platform LandlordInvest Now Seeking £300,000 Through Equity Crowdfunding Round on Crowdcube https://www.crowdfundinsider.com Click HERE to find out ⭐ P2P Lending Platform LandlordInvest Now Seeking £300,000 Through Equity Crowdfunding Round on Crowdcube. | Crowdfund Insider: ...